Find a Job You Really Want In

From avocado toast to putting the needs of all humanity above individual needs, millennials are a strange generation compared to the rest.

This is why they get such a hard time from the other generations.

From something being overexplained in a condescending way to being called a sensitive snowflake while also being told that every millennial is a lazy worker, you probably know what I’m talking about.

You know, mom always said that people will say hurtful things when they’re jealous. So, if the shoe fits and all.

Since you’ve already got a lot stacked up against you as a millennial, we figured we’d help out by finding the best millennial-friendly cities for you to relocate to.

You’ve already got all of the generations to worry about; you shouldn’t have to worry about living in poverty or not being able to buy a home.

That’s why we looked into median incomes, median home price, millennial unemployment, and percent of millennials living in poverty to determine the best cities.

Let’s take a look at the best cities you should relocate to.

Top 10 Best Cities for Millennials

- Broadview Heights, Ohio

- Mountain Brook, Alabama

- Roselle, Illinois

- Bryant, Arkansas

- Saginaw, Texas

- Palm City, Florida

- Irondequoit, New York

- Farmington, Minnesota

- Prairie Village, Kansas

- Fishers, Indiana

Now that you know you need to relocate, you better start packing.

Studies have shown that while millennials continue to buy a home like previous generations, it usually doesn’t happen until they’re in their 30s. Which is later than most other generations.

The reason being is that millennials take more time to save up for the bigger home, especially if it’s located in an “agrihood” because taking care of our environment is important.

With the paychecks you’ll find in these cities, maybe you won’t have to save up so long for that perfect house.

Don’t forget to keep reading for our full list of cities.

How We Determined The Best Cities For Millennials To Relocate

We looked at 2,249 cities and ranked them on the following areas:

- Median Income

- Percent of millennials in poverty

- Unemployment among millennials

- Median home price

Our criteria was to find affordable cities where paychecks stretch further, poverty is low, and jobs are plentiful.

However, big paychecks can come with big bills- so we tempered this metric by looking at the median home price. As millennials age, homeownership has become a priority: In order for a city to be ideal for millennials to relocate, home costs need to be reasonable.

All of our data came from the most recent Census ACS.

1. Broadview Heights, Ohio

Average Income: $45,808

Millennials in Poverty: 0.9%

Average Home Price:$243,100

Up first as the most millennial-friendly city is Broadview Heights, which is located in Ohio. Only 0.9% of the millennial population there is in poverty. Everyone else is thriving with an average income of $45,808. Plus, with the average home price being only $243,100, maybe you’ll be able to move in before you turn 30.

2. Mountain Brook, Alabama

Average Income: $75,105

Millennials in Poverty: 2.3%

Average Home Price:$605,300

With big checks come big responsibility. While Mountain Brook, Alabama, might have a bit more millennial’s in poverty and a higher average home price, the average income shoots up as well to $75,105. That’s quite a lot per year meaning it wouldn’t take long to pay off student debt and save up for a home. Plus Mountain Brook is about four hours away from the ocean, so it really doesn’t get better than that.

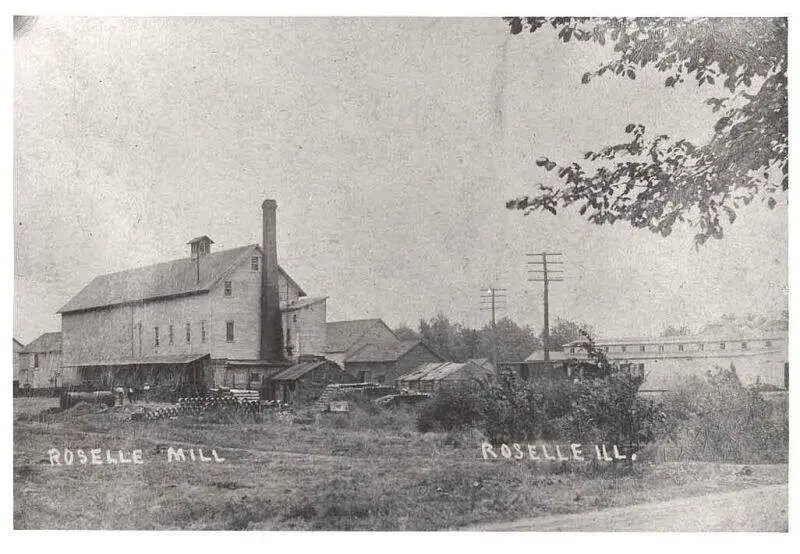

3. Roselle, Illinois

Average Income: $41,207

Millennials in Poverty: 4.1%

Average Home Price:$256,600

Just a little way out of Chicago is our third best city for millennials to relocate. Roselle, Illinois, may have over 4% of millennials living in poverty, but the rest are living their best lives there. With an average income of $41,207 and the average home price of only $256,600, you’ll be saying hello to your new home in no time. Cue the classic millennial picture of you holding the keys.

4. Bryant, Arkansas

Average Income: $37,614

Millennials in Poverty: 8.3%

Average Home Price:$163,900

Out of all the millennials living in Bryant, Arkansas, 8.3% are living in poverty. Sure, that might be a big number compared to some of these other cities, but Bryant also has a 0% unemployment rate. That’s pretty hard to beat. Plus the city’s average home price is only $163,900. Your future home here practically buys itself!

5. Saginaw, Texas

Average Income: $43,342

Millennials in Poverty: 3.4%

Average Home Price:$151,200

Down in Saginaw, Texas, millennials are able to find homes for the price of water. Maybe that’s a bit of a stretch, but $151,200 for the average price of a home is nothing compared to how expensive homes in other cities go for.

6. Palm City, Florida

Average Income: $42,340

Millennials in Poverty: 7.2%

Average Home Price: $341,400

At No. 6, Palm City, Florida, is a great place for millennials to relocate. For starters, it offers a 0% unemployment rate. On top of that, the average income is $42,340. If that’s not enough to take care of your dog’s surgery, which was necessary after Fido ate another one of your socks, then we don’t know what is. Maybe you can bring Fido to the beach afterward for a little fun in the sun action.

7. Irondequoit, New York

Average Income: $39,239

Millennials in Poverty: 7.2%

Average Home Price:$120,900

The good news about No. 7 is that there is a place in New York that is reasonably priced and easy to live. Irondequoit is the perfect place for millennials to thrive. Since the average home price is only $120,900, we think you can afford to ditch the box or the bridge you’ve been living under and close on your dream home. So you can start spreading the news because you’re leaving today. You want to be a part of it. Well, you know how the song goes.

8. Farmington, Minnesota

Average Income: $46,291

Millennials in Poverty: 2.6%

Average Home Price:$244,100

Farmington, Minnesota is the eighth-best place for millennials to relocate. It’s not surprising since it has a low millennial poverty line of 2.6%. Plus, with the average income of $46,291 and homes going for $244,100, you can put your salary to helping those below the poverty line instead of worrying about house payments.

9. Prairie Village, Kansas

Average Income: $51,862

Millennials in Poverty: 3.4%

Average Home Price:$261,300

Next up on the list is Prairie Village, Kansas. This is a great spot for millennials who are especially worried about their paycheck. The average income here is $51,862. That in addition to the city’s 0.45% unemployment rate, you won’t have any trouble keeping a job and growing your income.

10. Fishers, Indiana

Average Income: $55,311

Millennials in Poverty: 4.5%

Average Home Price:$249,900

Fishers, Indiana, completes our journey of finding great cities for millennials to relocate. The city offers an average income of $55,311, and we’re only getting started. The unemployment rate there is only at 1.5%, plus the homes average $249,900. You can celebrate with lots of avocado toast.

Summary of the Best Cities for Millennials to Relocate

Millennials already have a tough enough time in today’s world as it is. Worrying about how much they make or turning away a great home due to the pricetag shouldn’t be an added stress.

Instead, we found these 10 great cities that offer millennials all of that and more with their low home prices and high incomes. But we didn’t stop there.

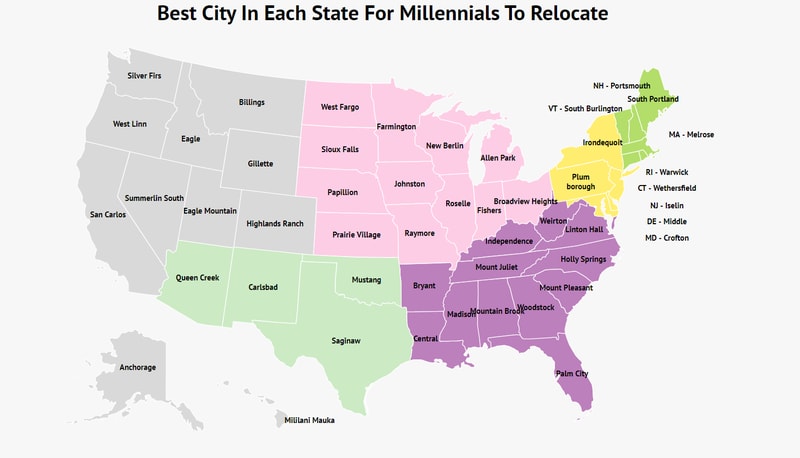

We found the best city in each state where millennials will thrive.

| State | City | Average Income | Unemployment | Poverty | Average Home Cost |

|---|---|---|---|---|---|

| Alabama | Mountain Brook | $75,105 | 0% | 2.30% | $605,300 |

| Alaska | Anchorage | $41,250 | 4.45% | 10% | $316,500 |

| Arizona | Queen Creek | $50,451 | 3.25% | 6.60% | $340,400 |

| Arkansas | Bryant | $37,614 | 0% | 8.30% | $163,900 |

| California | San Carlos | $91,084 | 1.45% | 3.70% | $1,541,900 |

| Colorado | Highlands Ranch | $59,004 | 2.85% | 4.60% | $443,000 |

| Connecticut | Wethersfield | $48,421 | 2.95% | 3.40% | $253,400 |

| Delaware | Middle | $47,657 | 9.95% | 6% | $280,900 |

| Florida | Palm City | $42,340 | 0% | 7.20% | $341,400 |

| Georgia | Woodstock | $42,258 | 1.55% | 7.50% | $224,100 |

| Hawaii | Mililani Mauka | $55,926 | 1.45% | 3.20% | $685,600 |

| Idaho | Eagle | $41,703 | 2% | 6.20% | $380,500 |

| Illinois | Roselle | $41,207 | 0% | 4.10% | $256,600 |

| Indiana | Fishers | $55,311 | 1.50% | 4.50% | $249,900 |

| Iowa | Johnston | $58,016 | 1.95% | 6.80% | $266,900 |

| Kansas | Prairie Village | $51,862 | 0.45% | 3.40% | $261,300 |

| Kentucky | Independence | $40,420 | 1.30% | 7.40% | $172,200 |

| Louisiana | Central | $41,424 | 3.65% | 5.70% | $209,600 |

| Maine | South Portland | $32,779 | 1.90% | 9.10% | $249,300 |

| Maryland | Crofton | $63,582 | 2.65% | 1% | $381,100 |

| Massachusetts | Melrose | $59,682 | 2.85% | 3.50% | $533,200 |

| Michigan | Allen Park | $39,596 | 2.70% | 11.10% | $121,500 |

| Minnesota | Farmington | $46,291 | 0.20% | 2.60% | $244,100 |

| Mississippi | Madison | $51,329 | 3.10% | 4.10% | $267,400 |

| Missouri | Raymore | $47,095 | 2.85% | 5.60% | $197,100 |

| Montana | Billings | $31,954 | 3.60% | 13.30% | $215,800 |

| Nebraska | Papillion | $37,664 | 1.80% | 2.80% | $181,400 |

| Nevada | Summerlin South | $57,614 | 4.05% | 6.70% | $388,200 |

| New Hampshire | Portsmouth | $44,391 | 2.40% | 5.90% | $408,500 |

| New Jersey | Iselin | $58,181 | 1.15% | 4.60% | $307,300 |

| New Mexico | Carlsbad | $57,290 | 4.60% | 8.70% | $796,900 |

| New York | Irondequoit | $39,239 | 2.60% | 7.20% | $120,900 |

| North Carolina | Holly Springs | $50,977 | 1.70% | 3.40% | $282,100 |

| North Dakota | West Fargo | $41,858 | 1.65% | 7.30% | $242,900 |

| Ohio | Broadview Heights | $45,808 | 0% | 0.90% | $243,100 |

| Oklahoma | Mustang | $38,381 | 2.35% | 6.40% | $157,900 |

| Oregon | West Linn | $52,485 | 1.45% | 7.50% | $471,100 |

| Pennsylvania | Plum | $41,265 | 5.05% | 3.20% | $154,600 |

| Rhode Island | Warwick | $41,583 | 5.35% | 7.40% | $214,200 |

| South Carolina | Mount Pleasant | $52,452 | 2.05% | 6.20% | $442,200 |

| South Dakota | Sioux Falls | $33,391 | 2.60% | 12.90% | $178,200 |

| Tennessee | Mount Juliet | $42,472 | 1.15% | 5.80% | $254,900 |

| Texas | Saginaw | $43,342 | 0.80% | 3.40% | $151,200 |

| Utah | Eagle Mountain | $39,597 | 0.65% | 4.30% | $251,600 |

| Vermont | South Burlington | $40,466 | 2.95% | 5.80% | $293,500 |

| Virginia | Linton Hall | $61,861 | 1.45% | 2.90% | $435,800 |

| Washington | Silver Firs | $59,830 | 1.10% | 3.60% | $453,000 |

| West Virginia | Weirton | $29,025 | 8.90% | 16.20% | $97,700 |

| Wisconsin | New Berlin | $47,046 | 1.10% | 3.30% | $252,500 |

| Wyoming | Gillette | $40,330 | 2% | 12.90% | $218,700 |