Research Summary. Although almost every industry took a hit from mandated covid closures, small businesses are bouncing back and continue to represent the backbone of the United States’ business community. After extensive research, our data analysis team concluded:

-

There are 32.5 million small businesses in the United States.

-

61.2 million people in the U.S. are employed by small businesses.

-

Small businesses have created an average of 525,000 new jobs each year since 2000

-

23% of small businesses closed due to the COVID-19 pandemic.

-

The average Paycheck Protection Program (PPP) loan in 2021 was $46,000.

-

20% of small businesses fail within their first year.

-

Only 55% of small businesses survive five years or more.

For further analysis, we broke down the data in the following ways:

Challenges| Trends | Demographics | Employment | Financing | Customers

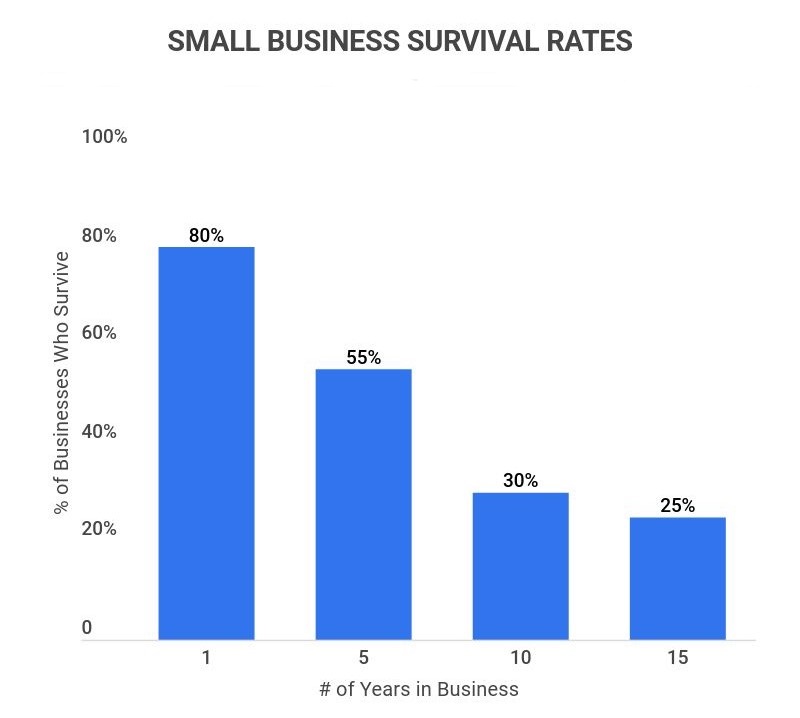

Small Business Survival Rate by Years in Business

| Number Of Years In Business | Percentage Of Businesses That Survive |

|---|---|

| 1 | 80% |

| 5 | 55% |

| 10 | 30% |

| 15 | 25% |

General Small Business Statistics

-

Less than half of all employees in the United States work for small businesses.

A Census Bureau survey found that approximately 47.3% of U.S. employees work for small businesses. Although this number is down from 52% in the early 2000s, small businesses continue to employ a significant portion of America’s working population.

Statistics show that 5% of the U.S. workforce is employed at small businesses with one to four employees, 12.6% work at companies with five to 10 employees, 16.7% are employed at businesses with 20 to 99 employees and 14% work for organizations with 100 to 499 employees.

-

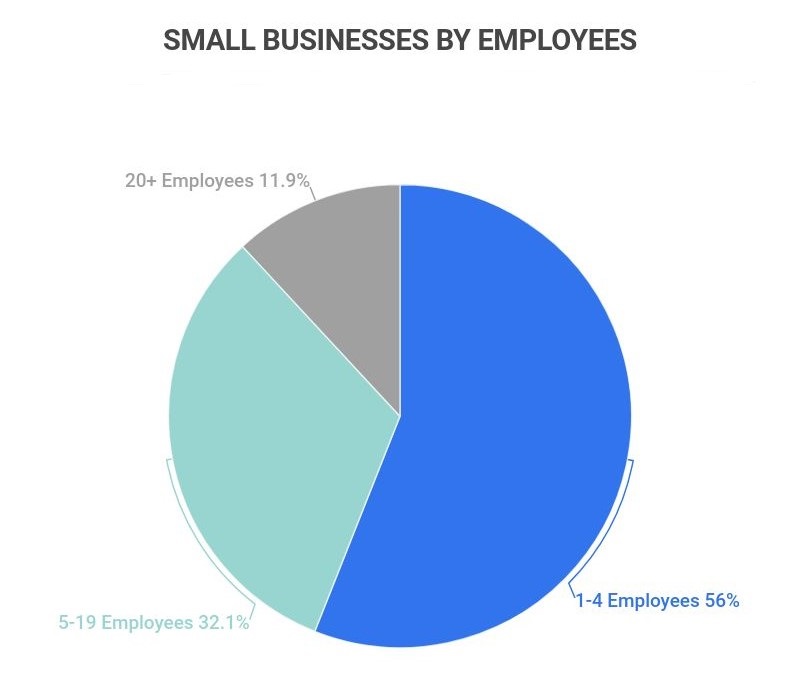

88.1% of small businesses have fewer than 20 employees.

According to data published by JP Morgan Chase from the U.S. Census Bureau, 56% of small businesses have one to four employees, and 32.1% have five to 19 employees.

The report also indicates that nearly 18% of all U.S. employees work for a small business with less than 20 employees, with 5% working for a company with one to four employees, and 12.6% working for a company with five to 19 employees.

-

99.9% of America’s business community is involved in small business.

Approximately 99.9% of businesses in the U.S. are classified as small businesses, meaning they are not dominant in their field and usually have fewer than 500 employees. On top of that, 45% of US economic activity (GDP) is tied to small businesses.

-

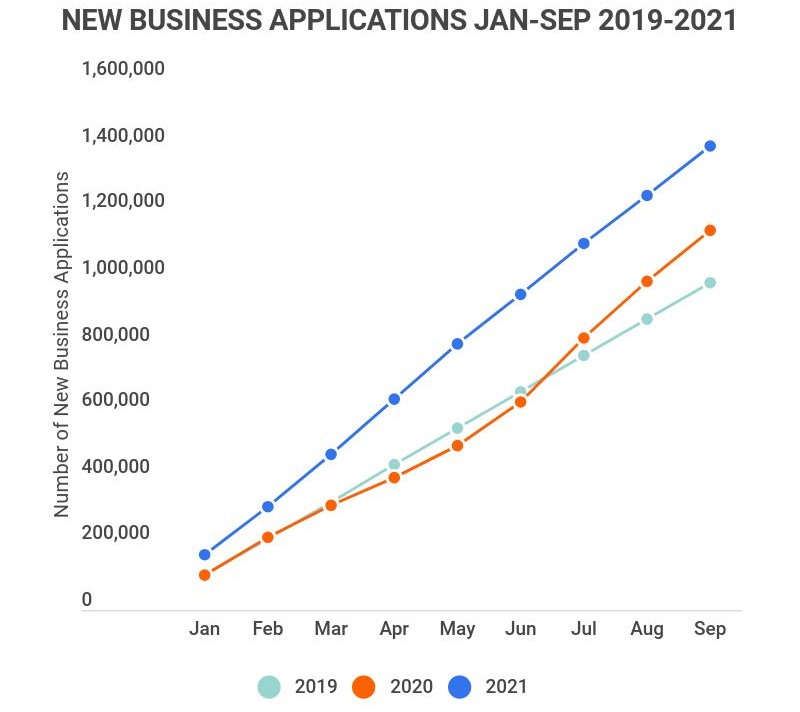

There were 1,536,432 new business applications in 2020.

That set a new record, and broke 2019 numbers by 16%. However, it appears that 2021 will break 2020’s record. As of September 2021, 1,396,792 new business applications had been sent, 22% more than September of 2020.

New Business Applications Through September (2019-2021)

| Year | New Business Applications |

|---|---|

| 2021 | 1,396,792 |

| 2020 | 1,141,922 |

| 2019 | 987,442 |

Small Business Challenges

-

Just 55% of small businesses survive past their fifth year in business.

With 20% of small businesses failing within their first year and 45% failing by their fifth year in business, the success rate for small businesses isn’t the best. In fact, labor statistics estimate that only 25% of small businesses survive past 15 years.

-

Money and management problems are the top reasons small businesses fail.

Almost all small businesses failures can be tied to financial management and cash flow problems. With 1 in 5 small businesses closing their doors within their first year of business, proper bookkeeping and budgeting have never been more important.

According to experts, some of the most common mistakes small business owners make include: using their personal bank account for business expenses, not tracking expenses, failing to adequately budget, ignoring business credit, and making mistakes on business taxes.

-

13.8% of big banks approve small business loans.

As of July 2021, small business loan approval ratings at big banks — or those with more than $10 million in assets — were approximately 13.8%, about half of what there were before the COVID-19 pandemic in early 2020.

Small business loan approval ratings are only about 5.3% better at small banks, with current approval ratings hovering around 19.1%. Prior to the pandemic, small banks approved more than 50% of small business loans.

-

26.5 small businesses did not receive any emergency federal loan money during the COVID-19 pandemic.

Although Congress approved a $700 billion relief program for small businesses hit hard by the global pandemic in 2020, only 4.2 million businesses received loans and grants from the Small Business Administration. As such, less than 14% of small businesses across the country received federal financial aid during COVID-19 lockdowns.

-

The biggest challenges facing small business owners today include low sales and difficulty gaining business credit access.

According to the U.S. Census Bureau’s Annual Survey of Entrepreneurs, about 25% of small business owners are forced to close their doors each year to do low sales and poor cash flow, and an additional 9.8% close their business due to issues related to gaining access to necessary business credit.

-

1 in 12 small businesses closes each year, on average.

An estimated 7% to 9% of all small businesses close each year, and that number is even hired for small businesses in their first year, with failure rates of about 20%. According to the U.S. Census Bureau, small business closure rates have stayed relatively the same for the past 25 years.

Small Business Trends and Predictions

-

23% of small businesses closed in May 2020, at the peak of the pandemic.

COVID-19 led many small businesses to shut their doors. However, closure rates varied by state and demographics. For instance, only 9% to 10% of small businesses in Main, Idaho, and Colorado closed, while 30% of small businesses in New York, Pennsylvania, and Massachusetts closed.

Meanwhile, female lead businesses had closure rates of 25%, compared to 20% for male lead businesses, and minority lead small businesses had closure rates of 27%, compared to 18% of others.

-

4.35 million small business applicants were submitted in 2020.

According to numbers gathered by the U.S. Business Formation, the number of small business applications submitted each year in the United States has grown by 74% since 2010. Business applications submitted in 2020 also represented a 24.19% increase from the 3.5 million applications submitted the year prior.

The influx of small business applications has continued into 2021, with 1.37 million submitted in the first quarter of the year and another 1.44 million submitted in the second quarter.

-

Since the pandemic started in March 2020, more than 100,000 small businesses have permanently closed due to the pandemic.

Researchers at the University of Illinois, Harvard Business School, Harvard University, and the University of Chicago found that the pandemic caused more than 100,000 small businesses to close their doors for good.

Closure rates were even higher in the restaurant industry, with 3% of all U.S. restaurants going out of business.

-

There are fewer new jobs available at small businesses now than there were in 1988.

According to the most recent available numbers from the U.S. Census, approximately 47% of U.S. employees work for small businesses, compared to 54.5% in 1988. As such, there are about 7.5% less jobs available in small businesses today than there were in 1988.

Small Business Demographics

-

Almost 30% of Americans are self-employed.

28.2% of the U.S. labor force, or approximately 44 million people, were self-employed at some point in 2019. In addition, 14% of Gallup respondents reported that their primary job was working as a self-employed independent contractor.

-

56% of small businesses in the U.S. are considered micro businesses.

More than half of all small businesses across the country are micro businesses, or businesses that employ four or less employees. Census data also suggests that 5% of the U.S. labor force works for a micro business.

-

32% of small businesses are owned by women.

Although at 68% the majority of small businesses in the United States are owned by men, 32% are now female owned. According to Guidant Financial and the Small Business Trends Alliance, there have been more female small businesses owners in the past few years than at any other point in American history.

-

As of 2021, there are 124,551 Black owned small businesses in the U.S.

According to the U.S. Census, African Americans owned 124,551 businesses, including 35,547 businesses in the health care and social assistance sector, the highest of any minority group.

-

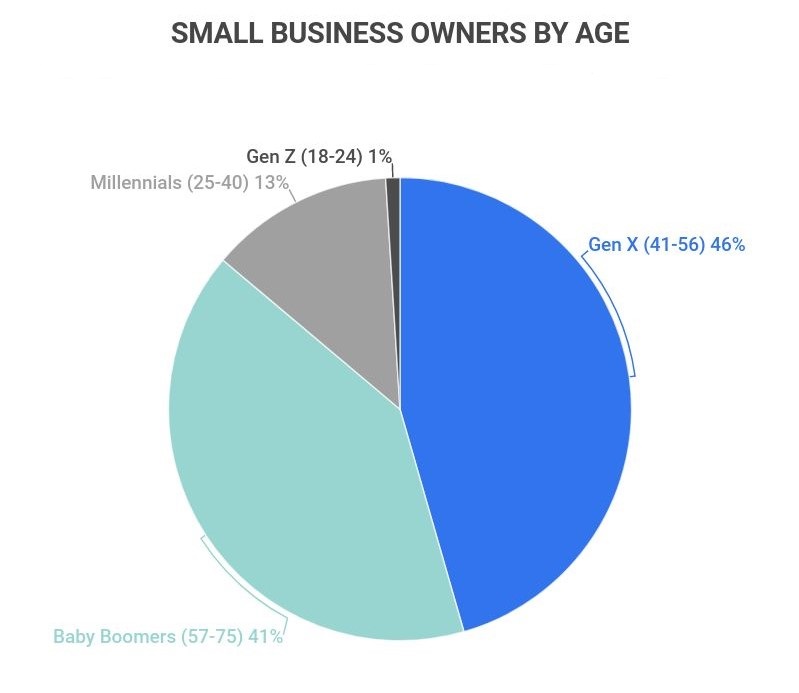

The majority of small businesses owners in the U.S. are between 41 and 56 years old.

46% of small business owners belong to Generation X, or are between 41 and 56 years old.

The survey also revealed that 41% of small business owners are Baby Boomers, or between 57 and 75 years old, while 13% are Millennials, or between 25 and 40 years old, and 1% belong to Generation Z, or younger than 24.

-

California has the most small businesses of any other state in the country, followed by Texas, Florida, New York, and Illinois.

According to statistics published by the U.S. Small Business Administration, there are 3.9 million small businesses in California, 2.6 million small businesses in Texas, 2.5 million small businesses in Florida, 2.1 million small businesses in New York, and 1.2 million small businesses in Illinois.

When compared to all businesses in each state, small businesses account for 99.85% of businesses in California, 99.78% of businesses in Texas, 99.81% of businesses in Florida, 99.78% of businesses in New York, and 99.62% of businesses in Illinois.

Small Business Employees

-

43% of small business owners are very happy with their jobs.

According to a 2021 survey, despite the recent challenges associated with the COVID-19 pandemic, 43% of small business owners are very happy with their jobs and an additional 31% are somewhat happy with their jobs.

-

Small business owners work twice as much as employees of big businesses.

According to a survey from New York Enterprise Report, 33% of small business owners work more than 50 hours each week and 25% of small business owners work more than 60 hours a week.

-

More than half of the country’s small and medium size businesses plan to offer employees with long term work from home options.

According to data published by the U.S. Small Business Administration, 57% of small businesses owners will continue to offer remote work options to their employees after the pandemic. As such, many businesses are revamping their technology, with 54% of small businesses spending more on software in 2020 than they did in 2019.

-

The average small business employee earns $45,857 each year.

According to the U.S. Census Bureau, small business employees earn an annual salary of approximately $49,467 at businesses with one to four employees, $39,658 at businesses with five to 19 employees, $43,231 at businesses with 20 to 99 employees, and $52,544 at businesses with 100 to 499 employees.

-

56% of small businesses have 4 employees or fewer.

And only 11.9% have more than 20 employees. The vast majority of small businesses are, well, small.

Small Business Financing Statistics

-

Average initial startup costs for small businesses typically range between $2,000 and $5,000.

The majority of microbusinesses in the United States require roughly $3,000 in starting funds, while home-based small businesses and franchises can cost anywhere between $2,000 and $5,000, according to the U.S. Small Business Administration.

After startup costs, the annual cost for a new small business with five employees is estimated to be approximately $184,830.

-

When seeking business financing, most small business owners apply for loans for less than $100,000.

According to the Small Business Credit Survey, 43% of small businesses applied for financing in 2018, and 57% of those businesses sought loans up to $100,000.

Of the small businesses that applied for financing, 20% sought loans less than $25,000, 37% sought loans between $25,000 and $100,000, 19% sought loans between $100,000 and $250,000, 16% sought loans between $250,000 and $1 million, and 8% sought loans for more than $1 million.

-

69% of small business owners fund their businesses using retained business earnings.

According to 2018 findings published in the Small Business Credit Survey, 69% of small businesses are funded through retained business earnings, 18% are funded through personal funds, and 13% are funded using external financing.

-

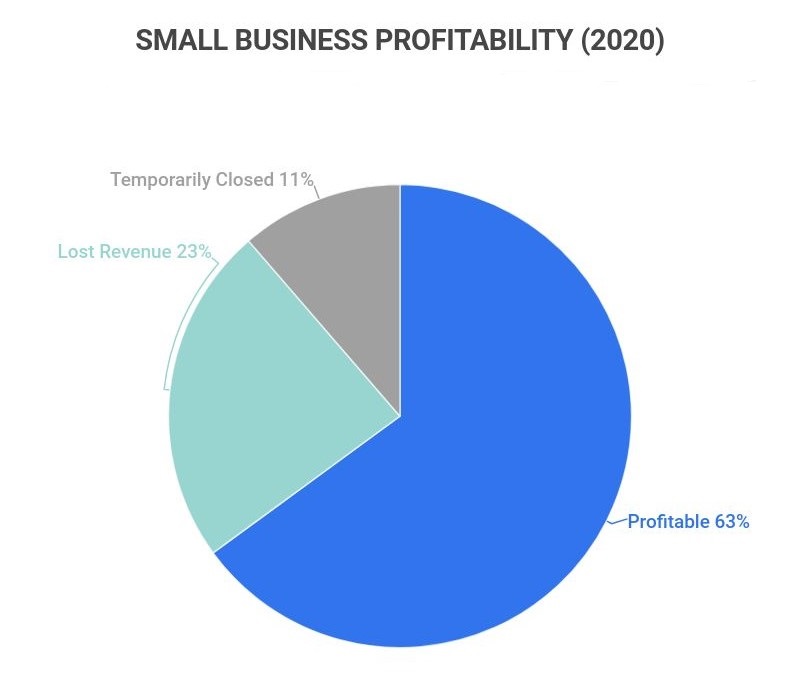

In 2020, 63% of small businesses were profitable.

Only 63% of small businesses were profitable in 2020, compared to 78% in 2019. The drop in profitability was largely due to COVID-19. The pandemic caused 23% of small businesses to suffer a loss of revenue and 11% to temporarily close their doors.

-

39% of small business owners finance their business with cash.

Small business owners finance their business in a variety of ways, with 39% using cash, 20% relying on 401(k) business financing, 10% relying on family and friends, 9% using an SBA loan or a line of credit, and 5% using an unsecured loan.

-

In 2018, 57% of small businesses did not apply for any business financing.

Of these businesses that opted not to apply for financing, an estimated 28% already had sufficient financing, while 29% had unmet financing needs. In addition, of the 43% of small businesses that applied for financing that year, 40% were declined financing, either in part or in full.

According to data published in the Small Business Credit Survey, approximately 20% of all small businesses in the United States do not use any external financing.

Small Business Customers

-

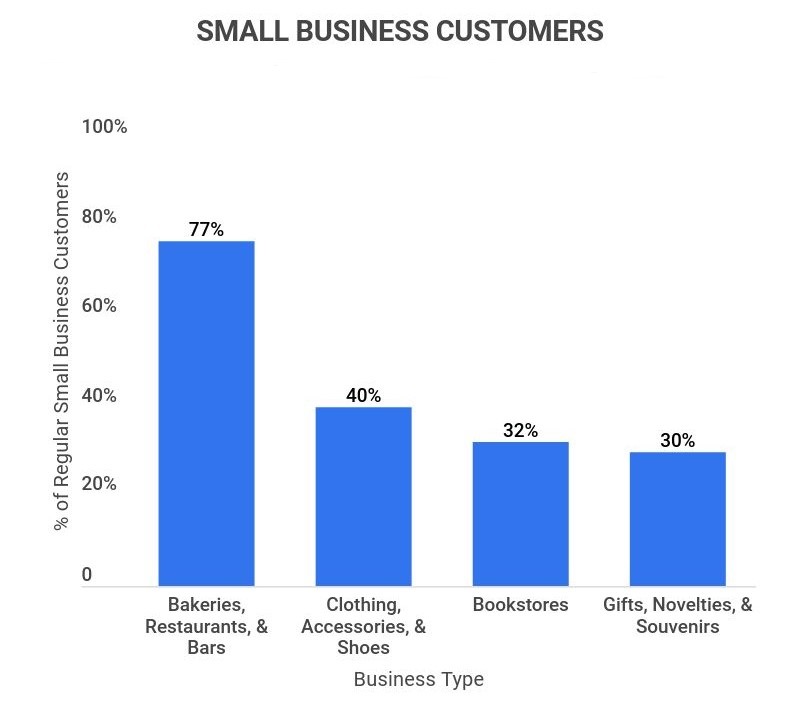

47% of Americans frequent small businesses anywhere from two to four times every week.

Statistics show that nearly half of all Americans rely on small businesses at least twice a week, and another 17% visit small businesses more than four times weekly.

According to a shopping survey, of all Americans who regularly shop at small businesses, 77% of them visit bakeries, restaurants, and bars, 40% of them visit clothing, accessory, and shoe stores, 32% of them visit bookstores, and 30% of them visit gift, novelty, and souvenir stores.

-

For every dollar spent at a small business, 67 cents stays in the community, with about 44 cents of every dollar going directly to the small business owner and their employees.

It’s also estimated that for every dollar spent at small businesses, an additional 50 cents is spent locally — 30 cents from the businesses using local vendors and 20 cents from the business owner and employees shopping locally.

In short, customers who invest in small businesses also invest in their local communities.

-

77% of small businesses use social media to communicate with customers and handle other areas of their business.

77% of small businesses in the United States use social media platforms to increase sales, launch marketing campaigns, and improve customer service.

The survey also found that 44% of small businesses reported that social media helps to improve their brand awareness and approximately 41% of small businesses rely on social media to drive sales and revenue.

Small Business FAQ

-

In the United States, there is no one widely accepted definition of what a small business is. The definition of a small business varies greatly by industry based on the business’s total number of employees and average annual revenue.

Generally speaking, the U.S. Small Business Administration classifies a small business as a company with fewer than 500 employees. However, some companies may qualify for small business status with more than 1,500 employees, depending on the industry.

As per federal standards, revenue for small businesses also varies by field and can range from $1 million to more than $40 million annually.

To classify as a small business, an organization usually needs to be a privately owned corporation, partnership, or sole proprietorship. Using these metrics, small businesses make up 99.9% of businesses across the country.

-

What is the success rate of small businesses?

The success rate of small businesses is 80% in the first year, down to 25% by year 15.

Success rates for small businesses vary based on the number of years a business has been in operation. On average, small businesses have a 55% success rate during their first five years of operation. Success rates, however, tend to drop as a small business ages. It’s estimated that 25% of small businesses survive past their 15th year.

Although success rates for small businesses aren’t as promising as those for larger businesses, small businesses continue to employ 46.8% of the U.S. labor force, generating 45% of the nation’s economic activity.

-

Are small businesses important to the US economy?

Yes, small businesses are extremely important to the US economy. An estimated 45% of US GDP is tied to small businesses and nearly 60 million Americans are employed by small businesses.

With nearly half of American workers dependent on small businesses for an income, and the entire country depending on them for essential goods and services, it’s evident that small businesses are very important for the US economy.

-

How many new small businesses start each year in the US?

Around 625,000 new businesses open each year in the US, according to estimates from the SBA.

Conclusion

With small businesses accounting for 99.9% of all businesses in the United States, it’s no surprise that 59.9 million Americans work at small businesses across the nation. Today, there are an estimated 32.5 million small businesses in the United States, 88.1% of which have fewer than 20 employees.

Challenges like financing hurdles, lower than average success rates, and mandated COVID-19 closures continue to threaten the livelihood of many small businesses. However, the future of America’s small business community remains bright. An estimated 47% of Americans shop at small businesses at least twice a week, generating about 45% of the nation’s economic activity.

Although 23% of small businesses were forced to shut their doors, either temporarily or permanently, due to the global pandemic, it’s safe to say that small businesses continue to represent the backbone of America’s business community.

References

-

JP Morgan Chase Co. “Small Businesses Are An Anchor Of The U.S. Economy.” Accessed on August 21, 2021.

-

CNBC. “U.S. Small Businesses Closures Are Ticking Back Toward COVID Pandemic Highs.” Accessed on August 22, 2021.

-

The Gazette. “Financial Mistakes Small Businesses Should Avoid.” Accessed on August 22, 2021.

-

Score. “Are Small Businesses Still Popular With Americans?” Accessed on August 22, 2021.

-

U.S. Small Business Administration. “2019 Small Business Profile.” Accessed on August 22, 2021.

-

Forbes. “Finding Capital: Where To Look If Banks Reject Your Small Business Loan Request.” Accessed on August 22, 2021.

-

U.S. Small Business Administration. “Small Business Facts: Why Do Businesses Close?” Accessed on August 22, 2021.

-

Oberlo. “How Many New Businesses Start Each Year?” Accessed on August 22, 2021.

-

The Washington Post. “Small Business Used To Define America’s Economy. The Pandemic Could Change That Forever.” Accessed on August 22, 2021.

-

U.S. Small Business Administration. “Top Business Trends For 2021.” Accessed on August 22, 2021.

-

Guidant Financial. “2021 Small Business Trends.” Accessed on August 22, 2021.

-

United States Census Bureau. “Annual Business Survey Release Provides Data On Minority-Owned, Veteran-Owned, And Women-Owned Businesses.” Accessed on August 22, 2021.

-

Forbes. “Survey: Nearly 30% Of Americans Are Self-Employed.” Accessed on August 22, 2021.

-

U.S. Small Business Administration. “State Rankings By Small Business Economic Indicators.” Accessed on August 24, 2021.

-

Score. “How Hard Small Business Owners Work.” Accessed on August 24, 2021.

-

Federal Reserve Banks. “Report On Employer Firms: Small Business Credit Survey.” Accessed on August 24, 2021.

-

Business News Daily. “Startup Costs: How Much Cash Will You Need?” Accessed on August 24, 2021.

-

PR Newswire. “77 Percent Of U.S. Small Businesses Use Social Media For Sales, Marketing, And Customer Service.” Accessed on August 24, 2021.

-

U.S. Small Business Administration. “2021 Small Business Profile.” January 9, 2021.