- Glossary

- What Is Gross Monthly Income?

- What Is Management?

- What Is A Problem Statement?

- What Is Annual Net Income?

- What Is A Letter Of Transmittal?

- What Is Attrition?

- What Does White Collar Mean?

- What Does Blue Collar Mean?

- What Is Efficiency Vs Effectiveness?

- What Is A Dislocated Worker?

- What Is Human Resource (HR)?

- Thank You Letter Scholarships

- What Is Constructive Criticism?

- What Is A Quarter Life Crisis?

- What Is Imposter Syndrome?

- What Is Notes Payable?

- Types Of Communication

- Economic Demand

- Cost Benefit Analysis

- Collective Bargaining

- Key Performance Indicators

- What Is Gender Bias In A Job Description?

- What Is The Hidden Job Market?

- What Is The Difference Between A Job Vs. A Career?

- What Is A Prorated Salary?

- W9 Vs. 1099

- Double Declining Balance Method

- Divergent Vs Convergent Thinking

- Budgeting Process

- Types Of Intelligence

- What Is Bargaining Power?

- What Is Operating Capital?

- Difference Between Margin Vs Markup

- Participative Leadership

- Autocratic Leadership

- Authoratarian Leadership

- Situational Leadership

- Difference Between Generalist Vs Specialist

- Strategic Leadership

- Competitive Strategies

- Equity Vs Equality

- What Is Marginalization?

- Colleague Vs Coworker

- What Is The Glass Ceiling?

- What Are Guilty Pleasures?

- Emotion Wheel

- Nepotism In The Workplace

- Sustainable Competitive Advantage

- Organizational Development

- Communication Styles

- Contingent Workers

- Passive Vs Non Passive Income

- Choose A Career

- Formulas

- APR Formula

- Total Variable Cost Formula

- How to Calculate Probability

- How To Find A Percentile

- How To Calculate Weighted Average

- What Is The Sample Mean?

- Hot To Calculate Growth Rate

- Hot To Calculate Inflation Rate

- How To Calculate Marginal Utility

- How To Average Percentages

- Calculate Debt To Asset Ratio

- How To Calculate Percent Yield

- Fixed Cost Formula

- How To Calculate Interest

- How To Calculate Earnings Per Share

- How To Calculate Retained Earnings

- How To Calculate Adjusted Gross Income

- How To Calculate Consumer Price Index

- How To Calculate Cost Of Goods Sold

- How To Calculate Correlation

- How To Calculate Confidence Interval

- How To Calculate Consumer Surplus

- How To Calculate Debt To Income Ratio

- How To Calculate Depreciation

- How To Calculate Elasticity Of Demand

- How To Calculate Equity

- How To Calculate Full Time Equivalent

- How To Calculate Gross Profit Percentage

- How To Calculate Margin Of Error

- How To Calculate Opportunity Cost

- How To Calculate Operating Cash Flow

- How To Calculate Operating Income

- How To Calculate Odds

- How To Calculate Percent Change

- How To Calculate Z Score

- Cost Of Capital Formula

- How To Calculate Time And A Half

- Types Of Variables

Find a Job You Really Want In

Your annual percentage rate (APR) is the interest rate paid each year on your loan, credit card, or another form of credit. Borrowing money from an institution has a cost to it. Banks and other financial institutions charge a certain percentage of the money borrowed from them to make a profit. APR is a percentage of your total balance due.

When borrowing money, it’s essential to keep in mind that the cost of the goods or services you bought with that money will increase with interest. Most of us are familiar with borrowing money in the form of a credit card. Being knowledgeable about your APR helps you make the best decisions around your loans and credit cards, and reminds you that there can be a real cost of convenient paying.

In this article, we explain how APR and associated concepts are defined, as well as types of APR and how to calculate it.

What Is Annual Percentage Rate (APR)?

APR is the full cost of borrowing from a bank or financial institution over the course of one year. It considers all the various costs associated with borrowing money, such as late fees, extra charges, administrative fees, and more. This makes it a great way to calculate the total cost of borrowing.

Put another way, the APR of a given loan is the total amount of interest paid each year, represented as a percentage of the loan. For instance, if a credit card has an APR of 10%, you would pay around $1,000 a year for every $10,000 borrowed. However, keep in mind that APR does not consider the possible compounding effect of interest.

APR is used to compare the costs of borrowing money from different lenders. If all other factors are equivalent, the credit card or loan with the lowest APR is going to be the least expensive.

However, a critical factor to consider is whether or not there is a “grace period” associated with your credit card (or other borrowed money). Grace periods, which most credit cards have, allow you to avoid paying any interest on your credit card if you can pay off your balance in full each month.

With this in mind, grace periods can help you to avoid the associated costs of APR. It’s always a good idea to check with your credit card issuer to determine your grace period’s terms and conditions.

Generally, credit card owners who can completely pay off their bills on time are not affected by APR. APR is determined based on the remaining unpaid balance, so if the card is regularly paid in full by the time the money is due, the APR does not apply.

Types of APR

A credit card’s APRs depend on the charges made. For instance, your lender may charge one APR for balance transfers from a different card, a second APR for purchases, and a third APR for cash advances. It’s also likely that your lender has penalty APRs set at high rates for customers who violate the terms of their cardholder agreement or don’t pay off their balance on time.

Some credit card companies may use an introductory APR as a marketing tactic to incentivize signing up for their card. These APRs are low or even 0%, in an attempt to attract new customers.

Your specific APRs are usually going to be based mainly on your credit score. Those with excellent credit are offered loans with much lower interest rates than those with bad credit.

Unfortunately, if you have been unable to pay off loans in time, your interest rates on borrowed money will be higher. That’s because you are seen as more of a potential liability to the financial institution (and more of a potential source of profit, but that is a discussion for another day).

Typically, loans come with either a fixed APR or a variable APR. The fundamental difference between these two is that a fixed APR loan has a set interest rate that will not change, and a variable APR loan has an interest rate that can change at any time.

In a fixed APR loan, the interest rate applied to a principal amount borrowed is guaranteed not to change. This means that the APR you calculate based upon your interest rate will also not change. The amount paid each year for money borrowed will remain at the same proportional rate.

In a variable APR loan, the interest rate applied to the principal amount occasionally changes, and the APR changes along with it. This change is dependent on changes in the U.S. prime lending rate or other indexes. The borrower is subject to pay more if there is an upward change in interest.

Typically, credit cards come with a variable rate, but certain cards, such as retail store cards, may have a fixed rate. Even a fixed rate is subject to change, though, but there are usually policies outlining how many days in advance you must be notified before this change occurs.

How to Calculate APR

Calculating the APR of a loan involves, as you might have guessed, a fair bit of mathematics.

For starters, you need to consider the principal amount, the number of years the loan lasts, and all of the extra charges associated with the loan outside of the interest.

The steps for calculating APR are as follows:

-

Calculate interest rate.

-

Add administrative fees to the amount of interest.

-

Divide by principal amount and number of periods of the loan, multiply all by one year and 100 .

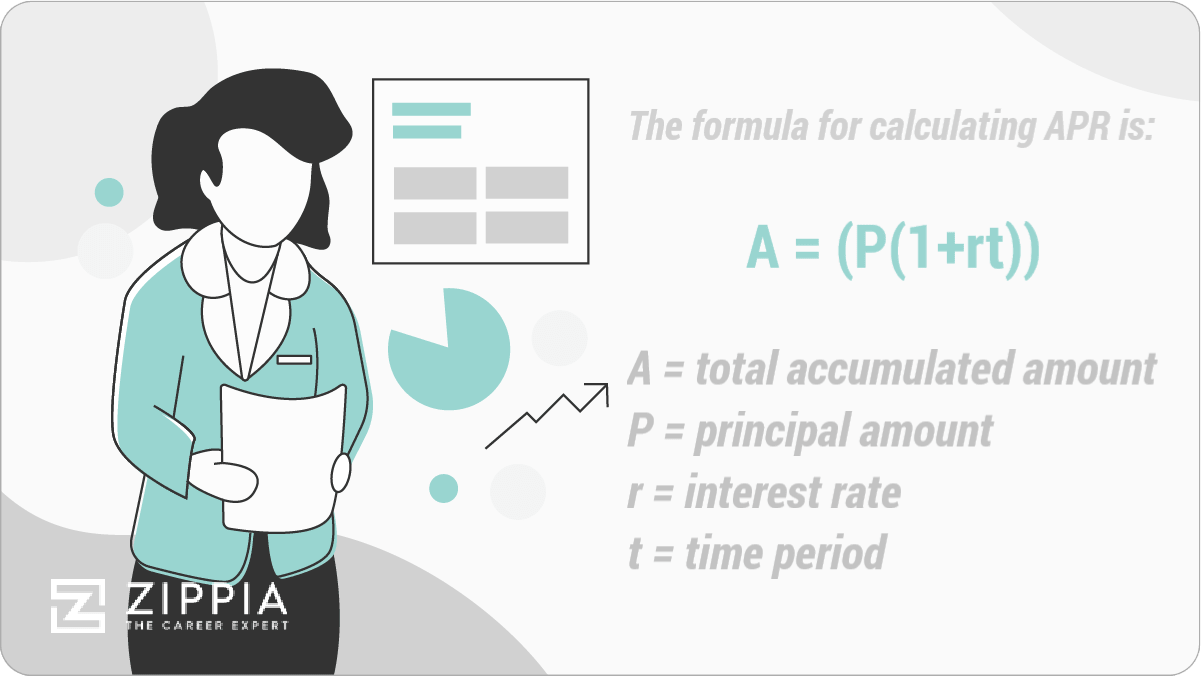

The Formula for calculating APR looks like this:

APR = (Fees + Interest) x 1 year x 100 / Principal amount, number of periods for loan

Here’s an example to help clarify:

You borrow $2,000 at a 5% interest rate for two years. The administrative fees amount to $200.

To find your APR, first, you’ll calculate the interest on the loan by using the following formula:

A = (P(1+rt))

A = total accumulated amount, P = principal amount, r = interest rate, t = time period.Following our example, P = $2000, r = 5% and t = 2 years. Thus, A = (2000(1+0.05×2)). When we solve this, it works out to A = $2,200.

Interest accumulated = A – P. $2200 – $2000 = $200, so we have interest = $200.

In the next step, you’ll add this interest to the administrative fees (fees + interest in the APR formula). The administrative fees are $200, so $200 + $200 = $400.

In the final step, you’ll divide the principal loan amount and the number of periods. Then you’ll multiply by one and 100 to come up with a percentage.

APR = (400/2000) / 2 x 1 x 100 = 10%

Now we know that the APR on this loan is 10%

These calculations can help find out the true cost of loans. It may appear at first that the interest rate on this loan is only 5%, but after calculating all of the charges, it turns out that this loan is actually 10% annually.

APR vs. APY

You may be in a situation where your loan is not calculated based on a simple interest rate. For instance, if your interest is compounded, as is the case for long-term loans such as mortgages and student loans, calculating APR will not be specific. This is because these loans are not based on simple interest models.

If you want to calculate the interest on a loan while taking into account the compounding effect of the interest, you should use annual percentage yield (APY) rather than APR.

APY is also the amount earned from a savings deposit, taking into consideration the compounding interest. APY will tell you the full amount that savings or investments will net over a given period of time.

APY tends to measure what a lender might gain when investing money somewhere, accounting for the number of times the investment is compounded.

The formula for finding APY is as follows:

APY = 100[(1 + interest/ principal amount) ^ (365/days in loan term) – 1]

And here’s an example to clarify:

You receive an interest of $40 for depositing an amount of $2000 in the bank.

APY = 100[(1 + 40/2000)^(365/365) -1], when we solve this, we get APY = 2%

Differences Between APR and Nominal Interest Rate

A nominal interest rate is sort of like a fake interest rate. It represents the interest rate without accounting for inflation, and it is not used in any official calculations by financial institutions. To get the real interest rate, you have to adjust the nominal interest rate for inflation.

The use of nominal interest rates is in creating a foundational interest rate that can then be further calculated to determine the actual interest rate. It is also usually the interest rate that banks use in advertisements and promotional material.

If you make an investment or a deposit within a bank, the money you make on this investment will be determined by the real interest rate. The real interest rate, again, is the nominal rate adjusted for inflation. This rate can increase, earning more money for the investor, or decrease, making less money for the investor.

The differences between APR and nominal interest rate, in general, have to do with the factors involved in the calculations and how these calculations are used. APR tells you the total cost of borrowing each year, whereas the nominal interest rate is used to determine how much money will be earned from a borrowed amount.

The APR is usually a more useful tool, as it is adjusted for inflation and considers the other non-interest costs associated with borrowing money. APR can help to more accurately compare loans, while nominal interest rate comparisons might be misleading.

APR FAQ

-

What is APR? APR stands for annual percentage rate. APR refers to the inerest rate for a whole year of a loan. For example, if you are loaned $1,000 and pay back $1,100 over the course of a year, your APR is 10%.

-

What is the formula for calculating APR? The formula for calculating APR is A = (P(1+rt)), where A = total accumulated amount, P = principal amount, r = interest rate, and t = time period.

-

How do you calculate monthly APR? Calculating your monthly APR begins by calculating your total APR. Your APR refers to one year. To find our monthly APR, simply divide your total APR by 12. Then, multiply that number by your current balance.

For example, let’s say your current balance is $1,200 and your APR is 10%. Divide the 10% by 12 to get 0.83%. Then, multiply that number by your $1,200 balance to get $10. Your monthly APR is 0.83%, or $10 in this example.

-

Is APR charged monthly? A credit card’s APR is typically applied monthly using the formula above. It depends on the terms of your loan, though.

-

What are the different types of APR? Credit cards differentiate APRs for different lending services:

-

Intro APR. Usually 0% for a year to attract new customers.

-

Cash advance APR. Typically the highest rate and the lowest credit limit that credit cards offer.

-

Balance transfer APR. Oftentimes, balance transfer APR is also offered at 0% for new clients. After the first year, this rate is commonly around the same as the purchase APR.

-

Purchase APR. The most typical rate you think of, purchase APR refers to the things you simply buy with your credit card.

-

-

What is a grace period? A grace period is the amount of time you have to pay off your credit card before interest applies. By law, grace periods must be at least 21 days long. You’re only in a grace period so long as you don’t carry a balance on your credit card.

Disadvantages of APR

APR can be a helpful tool for determining how much, in full, it will cost to borrow money. However, APR also has some downsides as a comparison tool, especially if it is the only tool being used.

If you plan to pay your loan in full-term, APR can be useful, but if you for any reason have to refinance your loan, its usefulness goes out the window. Your initial APR calculations and comparisons may prove to be obsolete if you refinance your loan, as the terms and conditions of getting a new APR from a new lender will be different.

It’s essential to calculate the APR of all of the lenders you are considering, as they can vary greatly. Make sure to be aware of any extra costs associated with borrowing and whether the interest rate is fixed or variable. In the case of variable interest rates, APR will typically not be a great tool of comparison because it can change at any time.

Finally, as mentioned previously, if there is a compounding effect on your interest rate, APR will likely not be an accurate tool of comparison.

- Glossary

- What Is Gross Monthly Income?

- What Is Management?

- What Is A Problem Statement?

- What Is Annual Net Income?

- What Is A Letter Of Transmittal?

- What Is Attrition?

- What Does White Collar Mean?

- What Does Blue Collar Mean?

- What Is Efficiency Vs Effectiveness?

- What Is A Dislocated Worker?

- What Is Human Resource (HR)?

- Thank You Letter Scholarships

- What Is Constructive Criticism?

- What Is A Quarter Life Crisis?

- What Is Imposter Syndrome?

- What Is Notes Payable?

- Types Of Communication

- Economic Demand

- Cost Benefit Analysis

- Collective Bargaining

- Key Performance Indicators

- What Is Gender Bias In A Job Description?

- What Is The Hidden Job Market?

- What Is The Difference Between A Job Vs. A Career?

- What Is A Prorated Salary?

- W9 Vs. 1099

- Double Declining Balance Method

- Divergent Vs Convergent Thinking

- Budgeting Process

- Types Of Intelligence

- What Is Bargaining Power?

- What Is Operating Capital?

- Difference Between Margin Vs Markup

- Participative Leadership

- Autocratic Leadership

- Authoratarian Leadership

- Situational Leadership

- Difference Between Generalist Vs Specialist

- Strategic Leadership

- Competitive Strategies

- Equity Vs Equality

- What Is Marginalization?

- Colleague Vs Coworker

- What Is The Glass Ceiling?

- What Are Guilty Pleasures?

- Emotion Wheel

- Nepotism In The Workplace

- Sustainable Competitive Advantage

- Organizational Development

- Communication Styles

- Contingent Workers

- Passive Vs Non Passive Income

- Choose A Career

- Formulas

- APR Formula

- Total Variable Cost Formula

- How to Calculate Probability

- How To Find A Percentile

- How To Calculate Weighted Average

- What Is The Sample Mean?

- Hot To Calculate Growth Rate

- Hot To Calculate Inflation Rate

- How To Calculate Marginal Utility

- How To Average Percentages

- Calculate Debt To Asset Ratio

- How To Calculate Percent Yield

- Fixed Cost Formula

- How To Calculate Interest

- How To Calculate Earnings Per Share

- How To Calculate Retained Earnings

- How To Calculate Adjusted Gross Income

- How To Calculate Consumer Price Index

- How To Calculate Cost Of Goods Sold

- How To Calculate Correlation

- How To Calculate Confidence Interval

- How To Calculate Consumer Surplus

- How To Calculate Debt To Income Ratio

- How To Calculate Depreciation

- How To Calculate Elasticity Of Demand

- How To Calculate Equity

- How To Calculate Full Time Equivalent

- How To Calculate Gross Profit Percentage

- How To Calculate Margin Of Error

- How To Calculate Opportunity Cost

- How To Calculate Operating Cash Flow

- How To Calculate Operating Income

- How To Calculate Odds

- How To Calculate Percent Change

- How To Calculate Z Score

- Cost Of Capital Formula

- How To Calculate Time And A Half

- Types Of Variables