- Determine Your Worth

- Average Salaries In The US

- What Is A Salary Range?

- What Is A Base Salary?

- What Is A Pay Grade?

- Average Salary Out Of College

- Your Salary History

- Competitive Pay

- Salary Vs. Hourly Pay

- What Is A Job Classification?

- How Many Hours Can A Teen Work?

- Average Work Hours Per Week

- What Is Annual Income

- Gross Salary

- How Many Hours Is Full Time

- How Many Work Hours In A Year

- Minimum Wage For Workers Who Receive Tips

- New York State Minimum Wage Rates

- Get A Raise

- Benefits

- Paid Time Off Policy (PTO)

- Leave of Absence Policy

- What Are Floating Holidays?

- What Are Employer-Paid Holidays?

- How Does Holiday Pay Work

- How Does A Stipend Work

- Cash a Paycheck Without a Bank Account

- What Is Compensatory Time?

- What's Unlimited Vacation?

- What Is A Commission?

- What Is A Mileage Deduction?

- Semimonthly Vs Biweekly Pay Schedules

- Flexible Spending Account

- Stock Options At Job

- Benefits Package

- Overtime Pay

- Workers Comp

- What Is Fmla

- Hazard Pay

- Tuition Reimbursement

- Discretionary Vs. Non-Discretionary Bonus

- What Are Union Benefits

- What Is An HRA Account

- What Is Cobra Insurance

- Negotiation

- What Exactly Is a Job Offer?

- How To Negotiate Salary

- Exempt Employee

- How To Answer Salary Requirements

- Employment History

- What Are Your Salary?

- Salary Counter Offer

- How To Answer Salary Expectations

- How Many Hours Is Part Time

- Signing Bonus

- Cost Of Living Adjustment

- How To Ask For A Salary Advance

- What Is Fair Labor Standards Act

Find a Job You Really Want In

While looking for employment, it’s important to understand what jobs qualify as full-time versus part-time work.

Full-time jobs often come with a host of benefits, such as healthcare insurance coverage, paid time off, and retirement plans.

However, what jobs constitute as such can be unclear, as the Fair Labor Standards Act (FLSA) doesn’t legally prescribe any guidelines that dictate whether a particular employee is a full-time worker.

In this article, we’ll discuss the nuances of what’s legally considered full-time employment. You’ll also learn the common benefits associated with full-time hours.

What Constitutes Full-Time Employment?

With the exception of certain designations under the Affordable Care Act (ACA), the United States Department of Labor does not legally define the number of hours individuals must work to be considered full-time employees.

This determination is instead primarily left to the policies and practices of individual companies.

One base requirement that the FLSA does dictate is that full-time employment is capped at 40 hours per week. Employees who work additional hours must be compensated with overtime pay that amounts to at least 50% on top of their base wage.

Common Company Policies on Full-Time Employment

The majority of employers in the United States regard full-time employment as exactly 40 hours per week.

However, it’s not uncommon for that figure to range as low as 30 hours and as high as 50.

How many hours you can expect to work to receive full-time status largely depends on the industry and type of company you’re applying to.

While office jobs at large corporations typically adhere to the 40 hours per week standard, many retail positions define 30 hours per week as full-time.

If you work at a start-up, your company may not even define full-time employment or a standard schedule at all. Workweeks may be as short or long as necessary to get the job done.

When applying to a position, make sure you thoroughly research the company’s policies and practices.

It’s not an uncommon practice in certain industries to hint at full-time hours in a job listing, only to scale down a worker’s hours once they’re hired in order to avoid paying out full-time benefits.

Make sure to research the company’s reputation and the experiences of previous workers to avoid being taken advantage of.

You should also keep in mind that barring a few exceptions; full-time employment doesn’t come with guaranteed access to any benefits. Do your research rather than relying on any assumptions before you accept a job offer.

Full-Time Employment Under the Affordable Care Act (ACA)

The Affordable Care Act considers any worker who works an average of 30 hours or more per week as a full-time employee.

Companies that employ 50 or more individuals are required to offer healthcare insurance to their full-time employees.

Employers must choose a historical period ranging between three and 12 months to assign a full-time status to employees that worked an average of 30 hours or more per week during that time period.

Companies must keep employees designated as full-time under that employment status for at least half a year.

Other Federal Laws Concerning Full-Time Employment

In addition to those dictated under the ACA, there are some other important federal laws regarding full-time employment benefits that you should know:

-

Employee Retirement Income Security Act (ERISA). It’s up to employers to define what constitutes full-time work.

However, the ERISA requires companies to provide the same retirement plans offered to full-time employees to any employee who has completed 1,000 hours of work within 12 months.

-

Setting Every Community Up for Retirement Enhancement (SECURE) Act. Beginning January 1, 2021, the SECURE Act will also extend these same full-time retirement benefits to any employees who work at least 500 hours annually for three consecutive years.

-

Employer transparency. All employers in the United States are required to be explicitly clear on the different benefits offered to full-time versus part-time employees, as well as their eligibility requirements.

If you’re looking for a job and a particular employer is being very vague or refusing to explain these aspects, then you should definitely view that as a red flag.

-

Voting leave. Federal law doesn’t require companies to allow their employees time off work to vote.

Thirty states practice such laws, but they vary widely over details such as whether employees must be paid, how much time they’re given, and what elections qualify.

Make sure to do the research wherever you live.

-

Exempt vs. non-exempt. Many state and federal laws, such as those included in The Fair Labor Standards Act (FLSA), require employers to classify workers as exempt or non-exempt.

Exempt employees are not eligible for many of the standards outlined by the FLSA, such as those regarding overtime pay and minimum hourly wage.

-

Working as a minor. Federal law caps full-time employment for minors at 40 hours a week.

There are many nuances that differ between state laws that you should research.

Generally, any conflict between federal and state laws over this matter errs towards the law that’s more protective and limits how long minors can work.

These laws also depend on the age of the minor. There are different limitations regarding individuals aged 14-15 versus ones aged 16-17.

The Benefits of Full-Time Employment

The benefits offered to employees vary depending on the employer’s industry and company size. However, here are some of the most common advantages you can expect to receive:

-

Paid time off (PTO). Paid time off refers to days employees can spend away from work while still receiving their regular wages.

There are variations in how employers offer paid time off. Here are some of the most common PTO plans:

-

Traditional PTO. Employees are given an allotted set of PTO days each year for specific categories, such as personal days, vacation time, and sick days.

On a given date each year, each employee’s PTO hours are reset. This means that any unused days from the previous years are wasted.

Some employers will incrementally increase a worker’s annual PTO hours, depending on how long they’ve worked at the company.

-

Accrued PTO. Accrued PTO plans are the same as traditional ones, except that unused days are carried over to the next year rather than disappearing.

There is also often no delineation between the reasons that employees take time off work. Sick days and vacation time would draw from the same “bank” of PTO hours.

-

Unlimited PTO. This trend is common in tech and startup companies. Employees are allowed to take time off from work as the need arises.

Of course, you should be careful not to exploit this policy if you’re working for a company that uses an unlimited PTO plan.

Taking too much time off work will reflect poorly on your professionalism. Many employees at such companies use less PTO than normal due to factors such as company culture and implicit expectations around work hours.

-

-

Retirement plans. Employers will offer a range of retirement plans to full-time workers.

The most common option among large businesses is 401(k) participation. Employees who enroll in a 401(k) plan may allocate a certain percentage of their income each paycheck.

Companies will also often offer a 401(k) match, meaning they’ll contribute an additional amount to your 401(k) that matches your personal contributions.

A common misconception is that a 401(k) by itself is an investment fund. Rather, it’s the tax environment in which you can make investments.

Your contributions will remain uninvested unless you remember to log into your 401(k) and actually choose a fund to participate in.

Many small businesses won’t offer you 401(k) plans, instead opting for self-employed pension individual retirement accounts (SEP-IRA).

The nuances and differences are complex, so make sure to do adequate research.

You should also keep in mind that many companies link their retirement plans with vesting policies. These dictate a certain amount of time (for example, two years) that full-time employees must stay at the company to receive all benefits.

If you unknowingly quit too soon, you may lose the 401(k) match that your employer contributed.

-

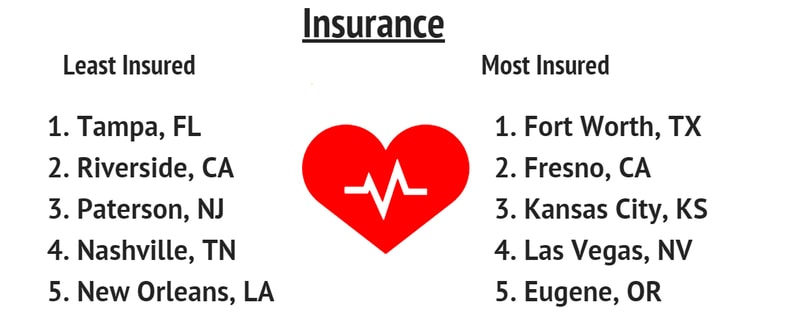

Health insurance. Healthcare coverage is perhaps the most important reason that job seekers pursue full-time positions.

We’re all aware of the tremendous cost of healthcare for uninsured individuals. Participating in your company’s health insurance plans can offset most of these expenses.

Most companies offer a variety of plans to full-time employees, so make sure you thoroughly weigh the pros and cons of each one in regards to your personal situation.

Participating in these plans will often deduct a premium from each of your paychecks. Unless you’re already covered under your own health insurance, this expense is well worth it in the vast majority of cases.

-

Pension. Although this practice is becoming less common, some companies still offer pension plans to full-time employees.

These are often alternatives to other retirement plans, such as 401(k)’s.

Pensions guarantee a certain amount of annual income to workers once they retire. These specific annual values depend on the company and the tenure of the employee.

-

Maternity/Paternity leave. Many employers offer parental leave to full-time employees after they or their spouses give birth to a child.

The specifics of these policies vary depending on the company.

Parental leave may last anywhere between two weeks and a half a year. Employees may be paid their full salary during the period, a portion of their salary, or none at all.

The Family Medical and Leave Act (FMLA) dictates that companies with 50 or more employees must offer at least 12 weeks of unpaid leave.

-

Childcare. Some companies provide benefits to lessen the expenses of childcare for full-time employees.

This can take the form of free or discounted onsite childcare or simply funds to help employees pay for childcare through other parties.

- Determine Your Worth

- Average Salaries In The US

- What Is A Salary Range?

- What Is A Base Salary?

- What Is A Pay Grade?

- Average Salary Out Of College

- Your Salary History

- Competitive Pay

- Salary Vs. Hourly Pay

- What Is A Job Classification?

- How Many Hours Can A Teen Work?

- Average Work Hours Per Week

- What Is Annual Income

- Gross Salary

- How Many Hours Is Full Time

- How Many Work Hours In A Year

- Minimum Wage For Workers Who Receive Tips

- New York State Minimum Wage Rates

- Get A Raise

- Benefits

- Paid Time Off Policy (PTO)

- Leave of Absence Policy

- What Are Floating Holidays?

- What Are Employer-Paid Holidays?

- How Does Holiday Pay Work

- How Does A Stipend Work

- Cash a Paycheck Without a Bank Account

- What Is Compensatory Time?

- What's Unlimited Vacation?

- What Is A Commission?

- What Is A Mileage Deduction?

- Semimonthly Vs Biweekly Pay Schedules

- Flexible Spending Account

- Stock Options At Job

- Benefits Package

- Overtime Pay

- Workers Comp

- What Is Fmla

- Hazard Pay

- Tuition Reimbursement

- Discretionary Vs. Non-Discretionary Bonus

- What Are Union Benefits

- What Is An HRA Account

- What Is Cobra Insurance

- Negotiation

- What Exactly Is a Job Offer?

- How To Negotiate Salary

- Exempt Employee

- How To Answer Salary Requirements

- Employment History

- What Are Your Salary?

- Salary Counter Offer

- How To Answer Salary Expectations

- How Many Hours Is Part Time

- Signing Bonus

- Cost Of Living Adjustment

- How To Ask For A Salary Advance

- What Is Fair Labor Standards Act