- Determine Your Worth

- Average Salaries In The US

- What Is A Salary Range?

- What Is A Base Salary?

- What Is A Pay Grade?

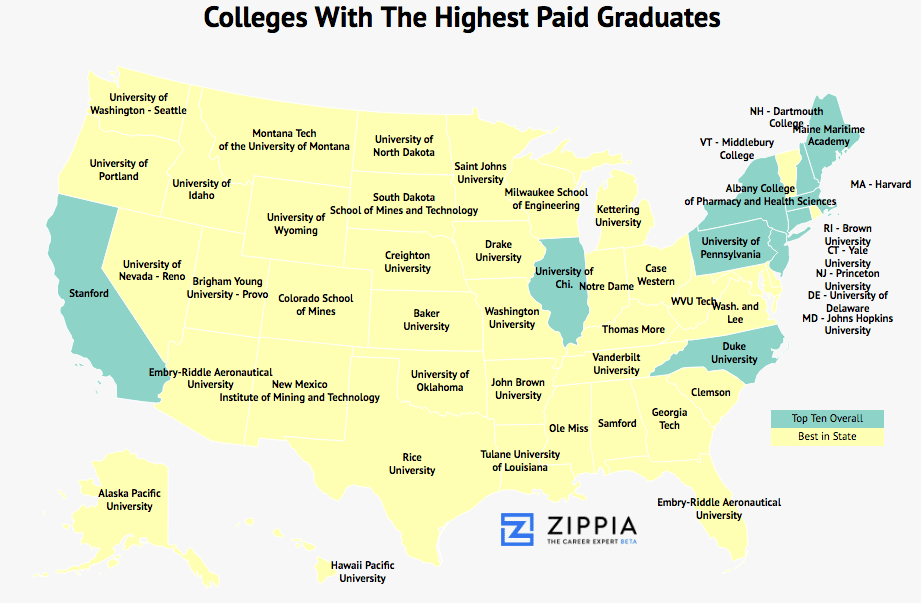

- Average Salary Out Of College

- Your Salary History

- Competitive Pay

- Salary Vs. Hourly Pay

- What Is A Job Classification?

- How Many Hours Can A Teen Work?

- Average Work Hours Per Week

- What Is Annual Income

- Gross Salary

- How Many Hours Is Full Time

- How Many Work Hours In A Year

- Minimum Wage For Workers Who Receive Tips

- New York State Minimum Wage Rates

- Get A Raise

- Benefits

- Paid Time Off Policy (PTO)

- Leave of Absence Policy

- What Are Floating Holidays?

- What Are Employer-Paid Holidays?

- How Does Holiday Pay Work

- How Does A Stipend Work

- Cash a Paycheck Without a Bank Account

- What Is Compensatory Time?

- What's Unlimited Vacation?

- What Is A Commission?

- What Is A Mileage Deduction?

- Semimonthly Vs Biweekly Pay Schedules

- Flexible Spending Account

- Stock Options At Job

- Benefits Package

- Overtime Pay

- Workers Comp

- What Is Fmla

- Hazard Pay

- Tuition Reimbursement

- Discretionary Vs. Non-Discretionary Bonus

- What Are Union Benefits

- What Is An HRA Account

- What Is Cobra Insurance

- Negotiation

- What Exactly Is a Job Offer?

- How To Negotiate Salary

- Exempt Employee

- How To Answer Salary Requirements

- Employment History

- What Are Your Salary?

- Salary Counter Offer

- How To Answer Salary Expectations

- How Many Hours Is Part Time

- Signing Bonus

- Cost Of Living Adjustment

- How To Ask For A Salary Advance

- What Is Fair Labor Standards Act

Find a Job You Really Want In

Whether you’re an employer or an employee, knowing the ins and outs of workers’ compensation is essential. Every state has different workers’ compensation laws, but there are some similarities between them.

Workers’ compensation insurance helps protect both businesses and employees in the case of workplace accidents and injuries.

It allows companies not to take on the brunt of the responsibility (and cost) for every workplace incident, and it ensures that injured employees receive income while their ability to work is compromised.

Below are some of the most common questions about workers’ compensation.

What Is Workers’ Compensation?

Workers’ compensation is a form of payment given to qualifying individuals who were injured or became sick due to their job. Workers’ compensation is given out after the injured employee files a worker’s compensation claim, and this claim is accepted as valid.

When it comes to workers’ compensation, it doesn’t really matter who is at fault. So long as the injury or sickness did not come about due to blatantly intentional or reckless behavior on the part of the employee filing a claim, it may still be a valid claim.

Who is at fault in this situation is less important than whether or not the injury, illness, or disability directly correlates to workplace tasks and activities.

Workers’ compensation is paid for by your employer’s workers’ compensation insurance. If you aren’t sure whether or not you qualify for workers’ compensation, always ask, especially if your ability to earn an income has been affected.

Understanding how worker’s compensation functions is crucial for making an informed decision on accepting your workers’ compensation. A good understanding of how this process works and who qualifies can also help you decide whether or not you should make a claim.

If you are injured during your work shift, it’s important to report this injury to your supervisor so it can be dealt with. Regardless of the circumstances, your employer legally must provide you with appropriate medical attention.

After the acute medical situation has been dealt with, you may get medical advice to take time off of work, and you may, at this point, qualify for worker’s compensation.

Who Is Qualified for Workers’ Compensation?

An employee working for a given company may qualify for workers’ compensation if the following criteria are met:

-

The employee suffered an injury, illness, or disability related to their work and the tasks of their job.

-

The employer has workers’ compensation insurance.

-

The workers’ compensation claim was filed within the timeline allowed based upon the regulations of the worker’s state of employment.

Workers’ compensation also applies in the case of death on the job. In these situations, workers’ compensation would pay out benefits to the worker’s surviving family and other dependents or beneficiaries.

What Does Workers’ Compensation Not Cover?

While workers’ compensation is here to protect both employees and businesses through an unfortunate situation, there are some instances where it does not apply.

These regulations vary based upon your state of employment, but in general, the following cases are typically disqualifying exceptions for receiving workers’ comp:

-

An employee starts a fight at work (i.e., is the aggressor) and sustains injuries because of this fight.

-

An employee is injured due to being intoxicated or using drugs or alcohol at work.

-

An employee intentionally injures themselves at work to receive workers’ comp.

-

An employee suffers emotional stress or injuries due to their workplace, but these are not accompanied by a physical workplace incident.

Top 10 Workers’ Compensation Questions

-

Where did workers’ compensation benefits come from? Workers’ compensation came about in the early 1900s, during a time of rapid industrialization in the United States. Before it was introduced, a worker’s only option for recourse due to a workplace injury or disability was suing their employer.

In court, employees would then have to prove that their injury was caused by a hazardous work environment. With the employer holding more money and power, courts often ruled in the employer’s favor.

The injured, sometimes permanently disabled, employee would then be left to fend for themselves. They had to either find a new job somehow despite their injuries or simply deal with having no source of income.

What was usually the case was that the employee could not even afford to sue their employer in the first place. Because of this clear imbalance, labor unions and activists pushed the idea of workers’ compensation insurance. By 1949, employers in nearly every state were required to purchase workers’ compensation insurance.

-

Who pays for workers’ compensation? Workers’ compensation insurance pays for compensation benefits for most employers, though some do pay these benefits directly.

Employers are required to purchase workers’ compensation insurance in every state, except for Texas and New Jersey. In those states, employers are responsible for making the decision themselves.

Employees do not have any role in paying for workers’ compensation benefits, as this is seen as a business expense and something that the employer is completely responsible for.

The cost of workers’ compensation for an employer depends on several factors. The size of the organization, as well as the state laws and regulations it is subject to, affect the cost of this insurance.

There are also different types of insurance based on the type of work an employee does and what risks they can expect to encounter on the job.

-

What should I do if I’m hurt on the job? If you’re injured on the job, you need to tell your supervisor immediately. They should then formally report the injury, including the time, date, and circumstances of the injury.

State regulations for when an injury should be reported vary, but it’s a good idea always to report the injury as soon as possible.

If you have an illness related to your job, it may be a bit more of a complicated process. If you are ill and you suspect it may be related to your job, you should see a medical professional as soon as possible.

Once you’ve received a diagnosis and have confirmation that this diagnosis is a result of your job, you should file a report immediately.

-

How do I file a workers’ compensation claim? After receiving proper medical treatment for your workplace illness or injury, first determine whether or not you’ll need time off from work to recover, and formally request this time off.

Then, do some research. The specific information you need will vary from state to state, so look into your state-specific guidelines. It’s almost always the case that the responsibility of submitting the paperwork for a workers’ compensation claim falls to the employer.

In general, the worker’s compensation claim will include at least the following information:

-

Company name and location

-

Company account number

-

Company policy number

-

Injured employee’s name, age, date of birth, and sex

-

Injured employee’s address, phone number, and social security number

-

The date the incident occurred

-

The type of injury

-

The approximate number of days the employee will lose

-

The expected date that the employee will return to work

-

Any witnesses to the incident

Once the employer has gathered all of the information required, the claim should be filed quickly. Some states have requirements for deadlines to submit claims relative to when the incident occurred.

-

-

What should I know before accepting workers’ compensation? If you remember our brief history of workers’ comp from earlier, you may have noted that it was proposed as an alternative to suing employers for workplace injuries.

This is an important fact to remember, as it still holds true today. By this, we mean that you are forfeiting your right to sue your employer over your workplace injury by receiving workers’ comp.

Before you accept workers’ compensation benefits, be very sure that you don’t want to take legal action against your employer. There are some significant downsides to taking legal action, some that were discussed earlier, but if your employer is criminally responsible for something, it may be the right choice.

In most scenarios, your best option is to take the workers’ compensation. If you’d like, you could get advice from an injury lawyer.

This is a good option if you have been gravely injured, if the injury threatens your life, or if you will become permanently disabled as a result of the injury.

-

What is workers’ compensation insurance? Workers’ compensation insurance helps cover the wages and medical benefits of an employee who was injured on the job. It ensures that neither employer nor employee has to take on the full weight of dealing with the expenses that come with a workplace injury.

-

Do I need to have workers’ compensation insurance? Employers, not individual employees, are required to have workers’ compensation insurance in almost all cases. Outside of Texas and New Jersey, any employer with even one single employee must purchase workers’ comp insurance.

Some companies can forego buying a separate workers’ comp insurance, instead acting as their own insurer. This typically only happens with large corporations, and they have to apply within their state and meet strict requirements.

However, certain types of workers and certain businesses are exempt from these state requirements. Independent contractors, volunteers, and domestic workers for private individuals are not typically covered by workers’ compensation insurance. Certain industries and charities are also not required to have workers’ compensation insurance.

Workers’ compensation is provided by either private insurance companies or state-funded insurance programs. In Ohio, Washington, North Dakota, and Wyoming, you must go through a state-funded insurance program.

-

Am I eligible for unemployment, disability, or social security benefits while receiving workers’ comp? There is no law expressly prohibiting people receiving workers’ compensation benefits from applying for disability, unemployment, or social security benefits.

You may be eligible for these benefits. The best way to sort this out is to contact your company’s benefits office and inquire about your eligibility for long-term disability, unemployment, and other benefits.

Keep in mind that the benefits you receive from other programs will be affected by the benefits you receive through workers’ comp. In other words, you may receive less from other programs if you are also receiving workers’ compensation at the same time.

- Determine Your Worth

- Average Salaries In The US

- What Is A Salary Range?

- What Is A Base Salary?

- What Is A Pay Grade?

- Average Salary Out Of College

- Your Salary History

- Competitive Pay

- Salary Vs. Hourly Pay

- What Is A Job Classification?

- How Many Hours Can A Teen Work?

- Average Work Hours Per Week

- What Is Annual Income

- Gross Salary

- How Many Hours Is Full Time

- How Many Work Hours In A Year

- Minimum Wage For Workers Who Receive Tips

- New York State Minimum Wage Rates

- Get A Raise

- Benefits

- Paid Time Off Policy (PTO)

- Leave of Absence Policy

- What Are Floating Holidays?

- What Are Employer-Paid Holidays?

- How Does Holiday Pay Work

- How Does A Stipend Work

- Cash a Paycheck Without a Bank Account

- What Is Compensatory Time?

- What's Unlimited Vacation?

- What Is A Commission?

- What Is A Mileage Deduction?

- Semimonthly Vs Biweekly Pay Schedules

- Flexible Spending Account

- Stock Options At Job

- Benefits Package

- Overtime Pay

- Workers Comp

- What Is Fmla

- Hazard Pay

- Tuition Reimbursement

- Discretionary Vs. Non-Discretionary Bonus

- What Are Union Benefits

- What Is An HRA Account

- What Is Cobra Insurance

- Negotiation

- What Exactly Is a Job Offer?

- How To Negotiate Salary

- Exempt Employee

- How To Answer Salary Requirements

- Employment History

- What Are Your Salary?

- Salary Counter Offer

- How To Answer Salary Expectations

- How Many Hours Is Part Time

- Signing Bonus

- Cost Of Living Adjustment

- How To Ask For A Salary Advance

- What Is Fair Labor Standards Act