Research Summary. Whether you need property, renovations, or are simply looking for some investment money, having money loaned out can be a regular part of owning a small business. These statistics can help you understand the trends behind small business lending in the US:

-

Large, nonlocal banks are responsible for 89.5% of smaller loans (less than $100,000) given to small businesses.

-

The average SBA loan is $417,316, while the maximum loan amount is $5 million.

-

33% of small business owners struggle or fail due to a lack of capital.

-

In 2020 the SBA distributed over 14 million loans worth $764 billion to small businesses.

For further analysis, we broke down the data in the following ways:

Loan | Application | Demographics | Industry

Small Business Financial Statistics

Despite the rewards, it can also be expensive to run a small business in the U.S. Additionally, many who have great ideas can only afford to jumpstart them with small business loans.

Overall, when it comes to the financial status of American small businesses, here are the facts:

-

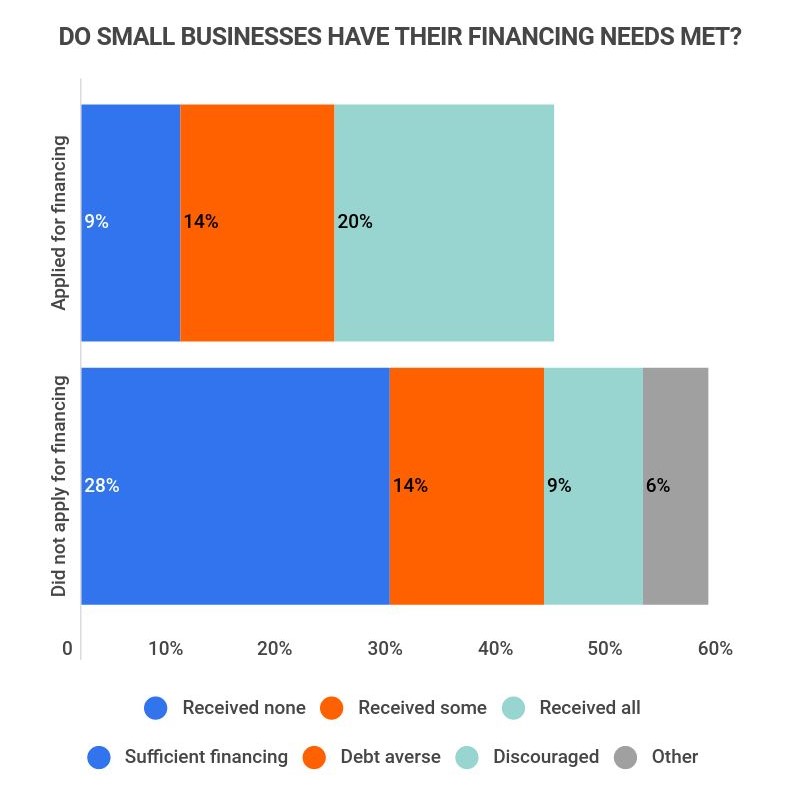

As a whole, only 48% of small businesses in the U.S. have their financing needs met.

That number includes the 20% of small businesses that achieved financing through loans and 28% that didn’t have sufficient capital without loans. On the other hand, a considerable 52% of small businesses receive no financing, only receive a portion of the financing they need or have too much debt to apply for loans.

-

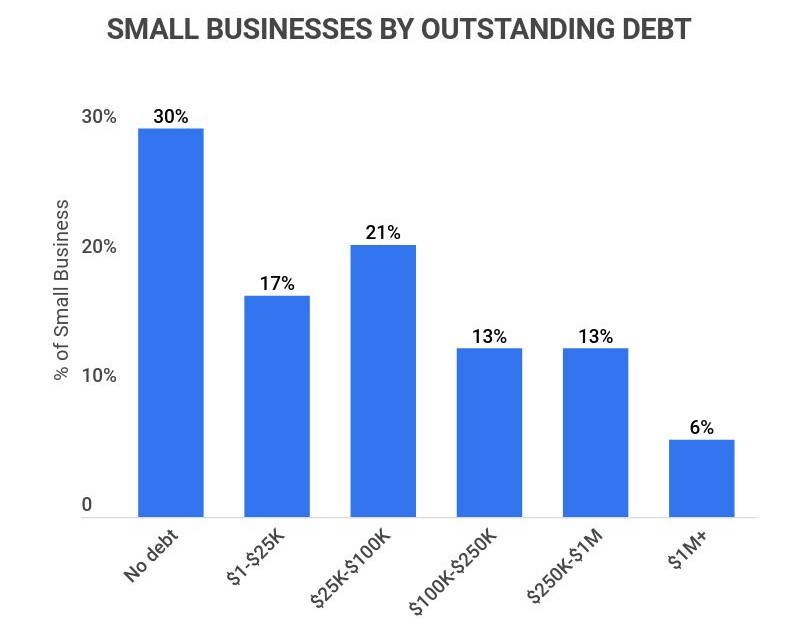

At least 70% of small businesses in the U.S. have outstanding debt.

While that means nearly 3/4 of small businesses are in debt in the U.S., it’s also important to note the varying amounts of debt. 38% of small businesses with debt owe less than $100,000, with that number being divided into 17% owing $1 to $25,000 and 21% owing between $25,000 to $100,000.

-

The average Small Business Administration (SBA) loan is $417,316.

However, the maximum loan amount for a standard loan is up to $5 million, with other smaller SBA loan types capping out between $350,000 and $500,000. Additionally, most loans over $25,000 require the lender to take some form of collateral, including trading assets.

-

Only 38% of small businesses took out a loan to expand in 2020.

The COVID-19 pandemic hit small businesses particularly hard, with the percentage taking out loans to expand reducing from 58% in 2019 to 38% in 2020. Instead, many small businesses have had to take out loans just to stay afloat.

-

The average interest rate for a small business loan is between 2.54% – 7.01%.

A majority of this disparity is connected to which bank, program, or administration the loan comes from. For instance, SBA loans have average interest rates between 5.50% to 8%.

-

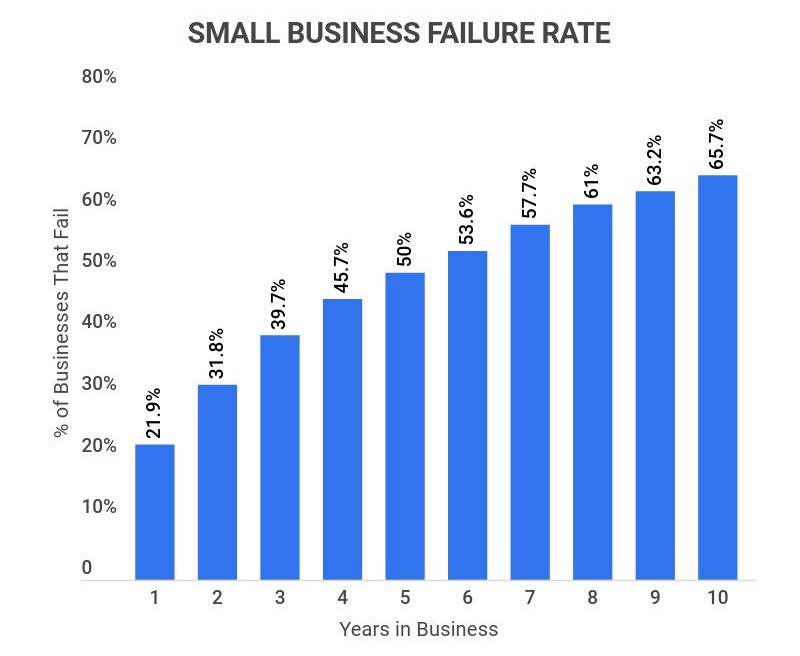

Only 33% of small businesses will survive ten years in business.

While the majority, 79.8%, can survive their first year. Unfortunately, survival rates continue to decrease over time until a small business reaches the ten-year mark, with 69.2% surviving two years and 50.2% making it five years.

Small Business Loan Statistics

Many businesses needed loans to expand, and during the height of the COVID-19 pandemic, many also needed loans to survive. Here are the facts about small business loans:

-

Overall, the average small business loan is $633,000.

This includes smaller regional and large banks, but it’s important to note the massive disparity between possible loan amounts. A small business can generally receive anything from $13,000 to $1.2 million from banks.

-

In 2020 the SBA distributed over fourteen million loans worth $764 billion to small businesses.

And of that $764 billion, $736 billion fell under the category of COVID-19 relief loans. That means that 96% of the loans distributed by the SBA in 2020 were for COVID-19 relief.

-

The average small business loan from alternative lenders is between $50,000-$80,000.

These lenders are typically private companies that operate online. Some of the most well-known alternative lenders include Fundbox, BlueVine, OnDeck, Credibly, Balboa Capital, QuarterSpot, and Funding Circle.

-

The average loan amount from large national banks is $593,000.

Unlike small regional banks, which only loan out an average of $146,000 to small businesses. At the other extreme, foreign banks give an average of $8.5 million to small businesses.

Small Business Loan Application Statistics

No one enjoys applying for loans, even if it’s necessary. However, it’s a common process, with just under half of all small businesses needing to apply for one. Here are the facts about small business loan applications, according to our research:

-

43% of small businesses applied for a loan in 2020.

Most of these businesses were those who needed COVID-19 relief, meaning that nearly half of American small businesses deeply struggled through the height of the pandemic.

-

Loan approval rates for small businesses applying to large banks are only 13.8%.

Whereas the approval rates from small banks are up to 19%, and non-bank loans have an approval rating of 24.7%. Overall, all of these approval rates are much lower than the rates for SBA loans.

-

32% of small businesses applying for loans now apply to non-bank lenders.

More and more small businesses are applying for loans from non-bank lenders, as this percentage is up from 24% in 2017 and 19% in 2016.

-

20% of small business loans are denied due to credit issues.

If a small business has weak or non-existing credit, this can have a huge impact on loan approval odds. It’s important to note that your business’s credit isn’t necessarily your personal credit, so you should watch both.

Small Business Loan Demographics

Given that there are huge disparities between the rural areas and cities in the U.S., it’s unsurprising that small businesses in different areas can have different outcomes. Additionally, the disparities between race, gender, and class can also play a role. Some common small business loan demographics include:

-

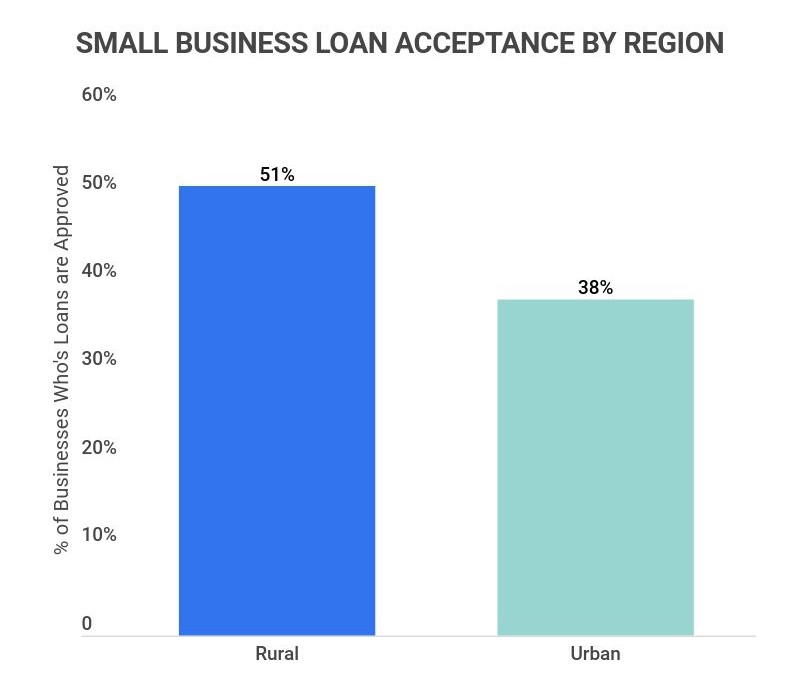

Rural small businesses are more likely to receive loans, with 51% acquiring all of the financing requested.

On the other hand, only 38% of urban small businesses receive the full financing amount they requested. This is especially interesting, given that only 17% of small businesses operate in rural areas.

-

Rural small businesses rely more heavily on small banks, with 62% of loan applications going to them.

Comparatively, 53% of urban small businesses apply for loans from larger banks, with only 43% reaching out to smaller banks. Of course, this isn’t surprising when you consider that 55% of the banks in rural areas are small banks, compared to only 25% in cities.

-

Black-owned businesses receive less than 2% of small business loans.

This is despite Black Americans making up 13% of the total population. In fact, studies have shown that Black-owned firms are twice as likely to see loan rejections, with less than 47% of financing applications being approved.

-

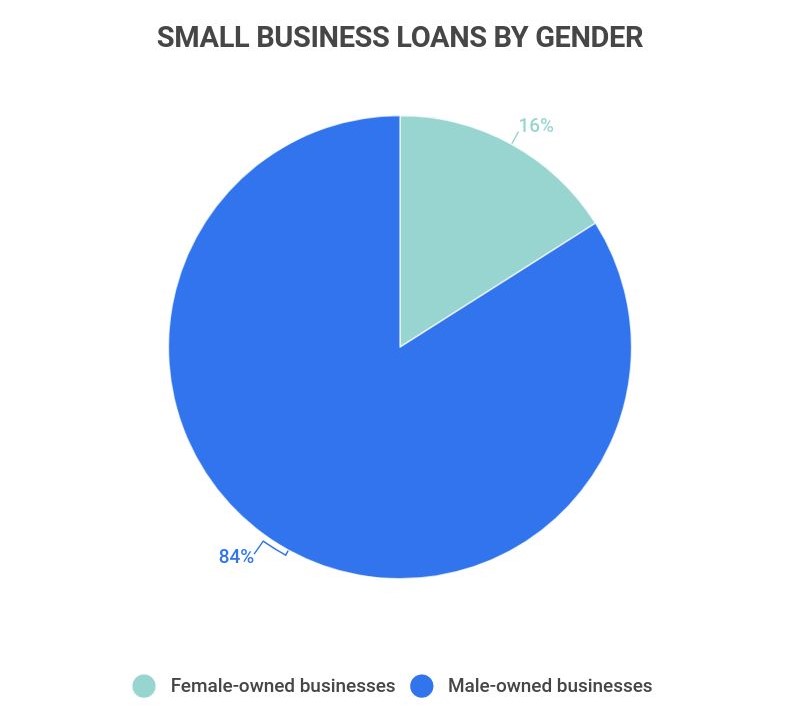

Women-owned small businesses receive only 16% of small business loans.

And this is even though women own roughly 30% of small companies. Overall, research has shown that women are more likely to be rejected or face more stringent terms than their male counterparts.

Small Business Loan Statistics by Industry

The type of industry a small business is in can also impact whether or not that business will be approved for loans. After all, the U.S. is home to small businesses that deal in anything from retail, fitness, car repair, and more. Overall, when it comes to small business loans by industry, here are the facts:

-

The construction and renovation industry receives the highest proportion of small business loans, roughly 15%.

Similarly, the second highest is Transportation and Trucking small businesses, receiving around 15% of small business loans. These industries tend to need loans to cover equipment, repairs, maintenance, and even turn a profit.

-

Full-service restaurants receive the highest volume of SBA small businesses loans, reaching 28,680 in 2019 alone.

Additionally, the limited-service restaurant businesses hold the #2 spot, with 19,141 loans distributed. This massive number of loans totaled over $17.1 billion combined. For context, the closest runner-up to the restaurant industries was the dental industry, which only amounted to 10,699 loans totaling $6 billion.

-

At least 11 potentially legal industries are not eligible for SBA small business loans.

These include Gambling, Government-Owned, Lending Loan Packaging Firms, Multi-Sales Distribution, Nonprofit, MLM, Real Estate Investment firms, Religious, and Speculation-Based industries.

Small Business Lending FAQ

-

What percent of small business loans are approved?

General small business loans have a 57% approval rate, while SBA loans, in particular, have a 52% approval rate. However, this number can be affected by the applicant’s location and the type of bank used, as well as race or gender.

For example, rural small businesses have 51% of applications approved, compared to only 38% of urban businesses.

This can be explained by the fact that urban businesses favor large banks, with approval ratings as low as 13.8%. With the approval rating for small banks being nearly 1.5x higher than that.

Additionally, Black Americans and other minorities also struggle with approval rates, as only 47% of loans requested by Black individuals are approved.

-

How are most small businesses financed?

Most small businesses are financed through the owner’s personal investments. This can include anything from their savings to personal assets. Even in 2020, when loan applications peaked, only 43% of small businesses applied for a small business loan.

However, when small businesses do require loans, the four most common ways of being financed are through: the SBA, large national banks, small regional banks, and alternative lenders. Financing through these lenders can be anything from a few thousand dollars to over a million.

-

Is small business lending profitable?

Yes and no. Due to increasing interest rates, small business loans can indeed be very profitable for lenders. Plus, a $500,000 loan might take as long as a mortgage to pay off, creating a large amount of time for that interest to add up.

On the other hand, small loans (less than $25,000) can be incredibly unprofitable for lenders, and if a lender sees a business venture as too risky, they probably won’t finance it. That’s because if the business collapses, they will lose their entire investment.

-

How much debt does the average small business have?

In the United States, the average small business owner is roughly $195,000 in debt. However, it’s important to note that a small business’ debt shouldn’t exceed more than 30% of your business capital.

-

How do small businesses qualify for loans?

There are four basic steps small businesses should take to qualify for loans. These include:

-

Building Credit. The first step to qualifying for any loan is building an attractive credit score, and small businesses are no different. You can either choose to improve your own personal credit or create solid business credit.

-

Research Qualifications & Requirements. You won’t know if you qualify for a loan if you don’t research it. Research any loan you’re interested in and understand the key differences between federal and bank loans.

-

Gather Documents. You’ll need to have the required financial and legal documents on hand if you want to qualify for a small business loan. This can include anything from personal, and business income tax returns to commercial licenses.

-

Show Lenders a Business Plan. Showing potential investors your business plan is a great way to build confidence. These plans include things like: company description, product/service description, industry analysis, facilities and operations plans, Current and projected financials, marketing strategies, and more.

-

-

Can you get a business loan with no revenue?

Yes, you can get a small business loan with no revenue. Though it may be more difficult, it is possible to achieve a small business loan with no revenue. After all, many businesses need loans to start operating.

With that in mind, here are some steps you can take to get a small business loan when you have no revenue:

-

Credit. Investors love high credit scores. If you have one, they’ll be far more likely to trust you with a loan.

-

Financial Projections. If you can at least somewhat accurately project how much money your business will make, lenders will feel more comfortable lending you money.

-

Business Plan. Like financial projections, a business plan will tell investors about your product/service, so they can decide whether or not they believe it’s worth investing in.

Plus, when all else fails, there are other ways you can get funded. Some of the most popular are either taking out business credit cards or crowdfunding campaigns.

-

-

What credit score do I need for an SBA loan?

You should try to have a credit score of at least 690 or higher if you plan to apply for an SBA loan. Having a score between 690-720 will give you good odds of landing a loan, while scores of 720+ will give you great odds.

While it isn’t impossible to get an SBA loan with a score lower than 690, it will definitely be harder. Many lenders can be scared off by the prospect of your business failing or a history of not making monthly payments on time, so it’s important to reassure them.

Conclusion

Due to the impact of the COVID-19 pandemic on small businesses, the process of acquiring loans is more important than ever before. After all, 33% of small business owners struggle or fail due to lack of capital, and only 48% have their financing needs met. In 2020 alone, 43% of small businesses applied for small businesses loans.

Of course, there is a disparity between loans and lenders. While the average small business loan is between $400,000 and $650,000, depending on the lender, loans can theoretically be as low as a few thousand dollars or as high as a million. And, with approval ratings no higher than 57%, it’s no surprise that a portion of applications is denied due to credit and capital issues.

Luckily, there are several avenues small businesses can take to acquire financing, such as reaching out to the SBA, large national banks, small regional banks, and alternative lenders.

Sources:

-

Federal Reserve Banks. “Small Business Credit Survey.” Accessed on November 22nd, 2021.

-

SBA. “Types of 7(a) loans.” Accessed on November 22nd, 2021.

-

Nerdwallet. “Average Business Loan Rate: What to Know About Interest Costs.” Accessed on November 22nd, 2021.

-

Entrepreneur. “The True Failure Rate of Small Businesses.” Accessed on November 22nd, 2021.

-

ValuePenguin. “Average Small Business Loan Amount: Across Banks and Alternative Lenders.” Accessed on November 23rd, 2021.

-

SBA. “SBA Achieves Historic Small Business Lending for Fiscal Year 2020 with More Than $17 Billion in SBA Seattle District.” Accessed on November 23rd, 2021.

-

Small Business Trends. “Small Business Loan Approval Rates Up at Big Banks.” Accessed on November 23rd, 2021.

-

FRB. “Access to Financial Services Matters to Small Businesses.” Accessed on November 23rd, 2021.

-

FORA Financial. “4 Steps to Take If You Aren’t Approved for an SBA Loan.” Accessed on November 23rd, 2021.

-

Fundera. “Rural Small Businesses Earn Better Profits and More Financing vs. City Ones.” Accessed on November 23rd, 2021.

-

The Guardian. “Black-owned firms are twice as likely to be rejected for loans. Is this discrimination?” Accessed on November 23rd, 2021.

-

Ondeck. “How the Gender Gap Affects Small Business Loan Approvals.” Accessed on November 23rd, 2021.

-

FORA Financial. “The Industries Most Likely to Ask for a Business Loan and Why.” Accessed on November 23rd, 2021.

-

WestTown Bank Trust. “The Top 40 Industries for SBA Financing in 2020.” Accessed on November 23rd, 2021.

-

SBA. “Does Your Industry Qualify for an SBA 7(a) Loan? Will You Benefit?” Accessed on November 23rd, 2021.