Research Summary: Despite Bitcoin’s notorious volatility, its importance in the modern market is ever-growing. That’s why it’s important to know how the currency is impacting the business world. After all, today’s digital landscape is constantly changing, and businesses will have to adjust to Bitcoin’s popularity. According to our extensive research:

-

Approximately 15,174 businesses worldwide accept Bitcoin, with around 2,300 of those businesses operating in the US.

-

There are 36,659 Bitcoin ATMs available in the U.S., as of April 2022.

-

As of 2020, 28% of American small businesses accept cryptocurrency as payment.

-

As of May 2022, there were roughly 260,000 Bitcoin transactions per day in the U.S.

-

Each day there’s over $1 million spent on goods and services with Bitcoin in the U.S.

-

Up to 40% customers who pay with Bitcoin are new customers who spend twice as much money as credit card users.

For further analysis, we broke down the data in the following ways:

Industry | Location | Over Time | Users

General Bitcoin Acceptance Statistics

As Bitcoin becomes more and more accessible and valuable, we can expect an increased number of businesses to accept it. However, when it comes to the current state of Bitcoin acceptance, here are the facts:

-

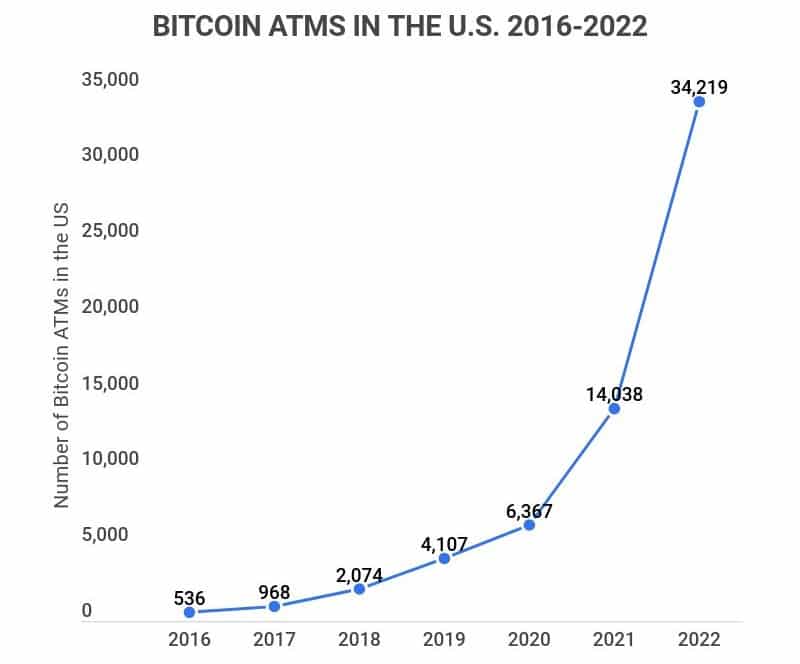

There are 36,659 Bitcoin ATMs available in the U.S.

Which is a huge increase from just last year alone. From January 2021 to January 2022, the number of ATMs installed increased from 14,038 machines to 34,219. That’s an explosive 144% growth in the number of Bitcoin ATMs installed.

A big part of that is major retailers, like Walmart, who’ve big plans underway to introduce another 8,000 Bitcoin ATMs over the next couple of years.

-

The U.S. has 86.8% of the world’s Bitcoin holdings.

Even more incredible is that this 86.8% is almost entirely spread across only 12 major companies. The only other country with a considerable amount of Bitcoin holdings is Canada, which is only at 9.3%.

-

An estimated 2,300 businesses now accept Bitcoin in the U.S.

Some of the most noteworthy American companies who currently accept Bitcoin include Microsoft and ATT, but you might be surprised how many food companies accept Bitcoin. For instance, Burger King, KFC, Subway, and Pizza Hut all accept Bitcoin.

When we expand to look at companies that accept at least one cryptocurrency, the number balloons to 36% of U.S. small-mid sized companies.

-

Microsoft is the largest U.S. company that accepts Bitcoin.

With a net worth of over $300 billion, Microsoft is by far the largest U.S. company that accepts bitcoin. The second largest is ATT, which has a net worth of $266 billion.

Top Industries for Bitcoin Transactions

While you’d probably expect the information technology industry to have the most Bitcoin transactions, you might be surprised which industries actually do have the most. While information technology is an important business for Bitcoin, here are the facts about industries that use Bitcoin the most:

-

The top five industries that accept Bitcoin are the Gambling, Tourism, Banking, Food, and Retail industries.

With the biggest industry being Gambling. Believe it or not, 50% of all Bitcoin transactions are in online games, and further, many online casinos even encourage Bitcoin use. Cloudbet and Duckdice are two large Bitcoin casinos that offer generous bonuses for the use of Bitcoin.

-

Binance is currently the largest Bitcoin marketplace, with approximately 1538 active markets.

That’s almost 32 million visits per week. Since its move from China, this 4-year-old company has continued to grow exponentially. Today, Binance plays a huge role in Bitcoin exchange and transactions.

-

The Information Technology Industry has 66.8% of all Bitcoin holdings.

While the Information Technology industry isn’t responsible for the most Bitcoin transactions, it does have the most Bitcoin holdings. These holdings can be for other companies, or even countries. This isn’t incredibly surprising, given the digital nature of the industry.

Top Locations for Bitcoin Transactions

If it wasn’t made obvious that the U.S. is the largest hub for Bitcoin transactions, this section will elaborate further. Here are the top locations for Bitcoin Transactions, according to our research:

-

New Mexico has the most Bitcoin ATMs per person, at a rate of one ATM for every 695,000 people.

While New Mexico might not be your first thought when it comes to bitcoin ATMs, this state actually has the most relative to its population. New Mexico still holds the top spot despite the fact that California and Texas combined have 35% of the United State’s Bitcoin ATMs.

-

California is the best state for Crypto, with a 98 on Google Trends’ 100-point scale.

California is also the most crypto-ready state, with a score of 5.72 out of 10. Just behind California are New York, Washington, and New Jersey, which all have high Google Trends and crypto-ready scores as well.

-

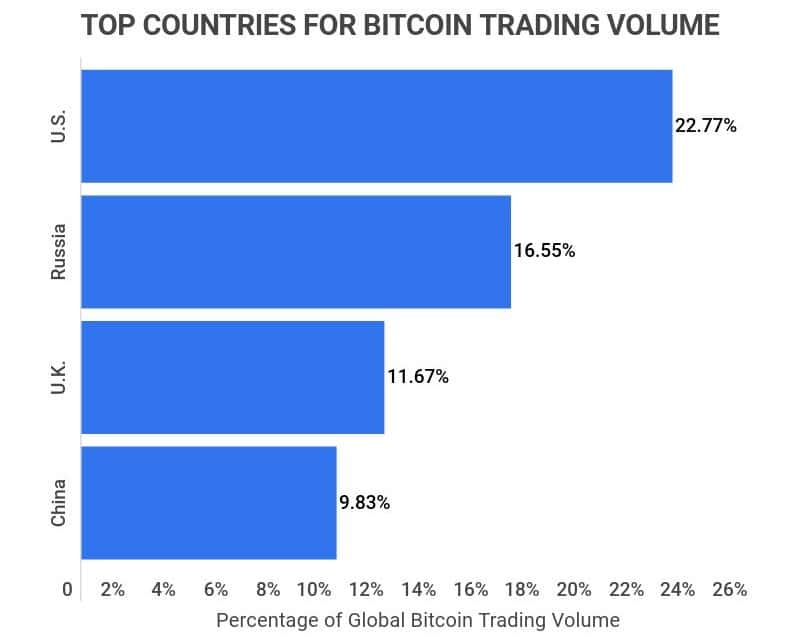

With 22.77% of the world’s Bitcoin volume, the U.S. trades the most Bitcoin.

That amounts to over $1.44 billion in Bitcoins. Other top countries include Russia (16.55%), the UK (11.67%), and China (9.83%).

-

San Francisco is the #1 city for Bitcoin transactions.

Not only is this city home to the cryptocurrency trading platforms Coinbase and Kraken, but also has 437 bitcoin ATMs. Other top Bitcoin cities include Vancouver, Canada, and Amsterdam, Netherlands.

Bitcoin Acceptance Over Time

As time goes on more and more businesses, cities and countries are beginning to use Bitcoin. In fact, there are no signs that Bitcoin usage around the world will be slowing down. Here are some significant Bitcoin acceptance trends, according to our research:

-

From 2011-2021, Bitcoin’s value has increased from $1 to over $58,000.

In 2020 alone, Bitcoin saw a price increase of over 300%. This partially explains Bitcoin’s newfound success and acceptance, as many investors have gotten very rich off of the cryptocurrency. Bitcoin’s fairly steady growth has made it a popular investment.

-

Crypto exchange users grew from less than a million users in 2014, to over 20 million in 2018.

And that number only continues to expand, with users throughout every continent on earth. For instance, developing countries such as Nigeria and Vietnam have seen considerable growth in the number of crypto owners.

-

Over the course of 2021, Bitcoin deposits grew by 28%.

This corresponds with a global crypto user growth rate of 15.7%, which has fueled an increase in Bitcoin trades, exchanges, and deposits.

-

The number of Bitcoin ATMs in the US has grown by 6,284% since 2016.

From just 536 Bitcoin ATMs in 2016, the machines have transformed from novelties to everyday pieces of technology. With major retailers like Walmart unrolling plans to install thousands more Bitcoin ATMs over the next few years, we can only expect this meteoric rise to continue its trajectory.

Bitcoin ATMs in the U.S. 2016-2022

| Year | Bitcoin Atms |

|---|---|

| 2022 | 34,219 |

| 2021 | 14,038 |

| 2020 | 6,367 |

| 2019 | 4,107 |

| 2018 | 2,074 |

| 2017 | 968 |

| 2016 | 536 |

Bitcoin User Statistics

Considering the fact that one Bitcoin is currently worth over $50,000, you might wonder how Bitcoins get spent. Well, here are some prominent Bitcoin Spender statistics:

-

Roughly 40% of customers who pay with crypto are new customers.

Plus, these customers typically purchase in amounts that are twice that of credit card users. With that in mind, crypto provides access to high-paying, tech-savvy clientele.

-

Crypto-Linked Card Usage reached over $1 billion in the first half of 2021 alone.

Crypto-linked card usage continues to reach an all-time high. This increase in spending clearly correlates with the fact that 93% of American and Canadian consumers plan to use either cryptocurrency or other new payment technologies within the next year.

Bitcoin FAQ

-

Can a small business accept Bitcoin?

Yes, small businesses can accept Bitcoin, or any other cryptocurrency. The first step to accepting any cryptocurrency payment is to create a branded cryptocurrency wallet, as well as sign up for a Bitcoin exchange such as Coinbase or Gemini. This will allow you to convert any payments you get into cash or other forms of currency, if you so choose.

The next step would be to add an easily accessible payment button/window to your website if you have one, or to a QR code in your shop. This will allow your customers to easily pay with Bitcoin.

-

Does Bitcoin still have a future?

Yes, Bitcoin does still have a future, even if it’s uncertain. Many large banks such as Citi have shown concern over Bitcoin’s volatility. Made especially evident by the currency’s fall in 2022, Bitcoin still has issues with custody, security, and capital efficiency that need to be addressed.

However, many large banks have also noted that Bitcoin is on the cusp of mainstream acceptance. In the end, this is extremely impressive, given the fact that the concept of digital currency is a very new part of our modern economy.

-

What are the risks of accepting Bitcoin?

There are a few risks that come with accepting Bitcoin. First and foremost, Bitcoin is an investment. That means that even though it’s immune to inflation, it can also be extremely volatile. Between 2021 and 2022, the value of Bitcoin fluctuated from over $60,000, to around $30,000, then all the way back up to $58,000, before plummeting to its current value of only $20,000.

That means that if you plan to hold on to your Bitcoin payments, instead of exchanging them into other currencies, you’ll run the risk of your payments losing value.

Another risk of Bitcoin payments is that they’re irreversible, which means that if your customers don’t trust you, they’ll be far less likely to buy. Given, this is more of a downside for the purchasing party.

And finally, the last risk that comes with Bitcoin transactions is taxes and regulations. This largely depends on the country you’re in, but for example, in the U.S. Bitcoin transactions are subject to a capital gains tax.

-

Why do businesses accept cryptocurrencies?

Businesses accept cryptocurrencies for a few major benefits. These include:

-

Improved Transaction Fees: Ever been annoyed when PayPal charges you extra for an immediate transfer? Well, due to a lack of a central intermediary, Bitcoin has little to no transaction fees. This means that businesses that choose to use Bitcoin will deal with far fewer transaction fees than those who allow credit cards, for example.

-

Protection for Merchants: Because crypto like Bitcoin is decentralized, this protects merchants from fraudulent chargebacks. In this way, all transactions are comparable to cash transactions, as they’re final.

-

More Sales Possibilities: Seeing as Bitcoin is easily accessible from most countries, that makes it easier for businesses to open up their customer base. Instead of dealing with outrageous extra charges, international buyers will have just as much access as domestic buyers.

-

-

What countries use cryptocurrencies the most?

These are the top 10 countries that use cryptocurrencies the most, based on the number of crypto owners:

-

India: 280.8 million crypto owners (20.45% of the total population).

-

United States: 46 million (13.74%).

-

Pakistan: 26.4 million (11.50%).

-

Nigeria: 22.3 million (10.34%).

-

Vietnam: 20.2 million (20.27%).

-

China: 19.9 million (1.33%).

-

Brazil: 16.6 million (7.75%).

-

Russia: 14.6 million (10.10%).

-

Indonesia: 12.2 million (4.45%).

-

South Africa: 7.7 million (12.45%).

-

Conclusion

As Bitcoin becomes more and more popular, we can expect an increased number of businesses to accept its use. Even today, there are already 15,174 businesses worldwide that accept Bitcoin, and roughly 2,300 of those businesses operate in the US. Further, there are also over 36,000 Bitcoin ATMs available in the U.S., and that number is only growing.

Due to these trends, 28% of American small businesses now accept cryptocurrency, which is no surprise, given that the U.S. has become a major hub for Bitcoin in particular. In fact, as of 2022 the U.S. is home to 86.8% of the world’s total Bitcoin holdings, as well as 22.77% of the world’s Bitcoin trades.

With that in mind, if you’re looking to move toward Bitcoin yourself, remember that some locations are better than others, and that every benefit also comes with a risk!

References

-

CoinTelegraph. “The number of Bitcoin ATMs in the US rose 177% over the past year.” Accessed on June 24th, 2022.

-

99 Bitcoins. “Who Accepts Bitcoin as Payment?” Accessed on June 24th, 2022.

-

LinkedIn. “Top 5 Industries That Accept Cryptocurrencies.” Accessed on June 24th, 2022.

-

CoinMarketCap. “Top Cryptocurrency Spot Exchanges.” Accessed on June 24th, 2022.

-

TAB. “Top ten companies with most bitcoin hold over 204,000 in total.” Accessed on June 24th, 2022.

-

CoinDesk. “The Top 5 US States for Bitcoin ATMs.” Accessed on June 24th, 2022.

-

RewardExpert. “Top States Where Cryptocurrency Is Catching On.” Accessed on June 24th, 2022.

-

C#Corner. “Top 10 Countries With The Most Cryptocurrency Holders.” Accessed on June 24th, 2022.

-

Investopedia. “10 Cities That Are Bitcoin Hotspots.” Accessed on June 24th, 2022.

-

Google Finance. “Bitcoin to United States Dollar.” Accessed on June 24th, 2022.

-

Medium. “12 Graphs That Show Just How Early The Cryptocurrency Market Is.” Accessed on June 24th, 2022.

-

Crypto.com. “Measuring Global Crypto Users.” Accessed on June 24th, 2022.

-

Deloitte. “The rise of using cryptocurrency in business.” Accessed on June 24th, 2022.

-

CNBC. “Visa says crypto-linked card usage tops $1 billion in first half of 2021.” Accessed on June 24th, 2022.

-

CoinATMradar. “Bitcoin ATM Installations Growth.” Accessed on June 24th, 2022.